Page 769 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 769

754 The Complete Guide to Executive Compensation

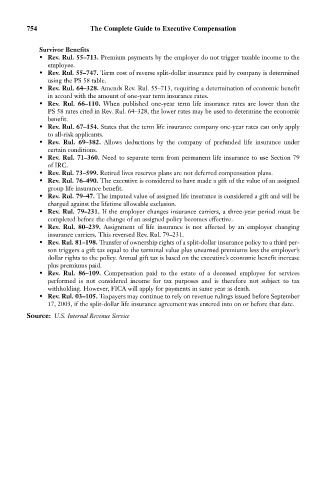

Survivor Benefits

• Rev. Rul. 55–713. Premium payments by the employer do not trigger taxable income to the

employee.

• Rev. Rul. 55–747. Term cost of reverse split-dollar insurance paid by company is determined

using the PS 58 table.

• Rev. Rul. 64–328. Amends Rev. Rul. 55–713, requiring a determination of economic benefit

in accord with the amount of one-year term insurance rates.

• Rev. Rul. 66–110. When published one-year term life insurance rates are lower than the

PS 58 rates cited in Rev. Rul. 64–328, the lower rates may be used to determine the economic

benefit.

• Rev. Rul. 67–154. States that the term life insurance company one-year rates can only apply

to all-risk applicants.

• Rev. Rul. 69–382. Allows deductions by the company of prefunded life insurance under

certain conditions.

• Rev. Rul. 71–360. Need to separate term from permanent life insurance to use Section 79

of IRC.

• Rev. Rul. 73–599. Retired lives reserves plans are not deferred compensation plans.

• Rev. Rul. 76–490. The executive is considered to have made a gift of the value of an assigned

group life insurance benefit.

• Rev. Rul. 79–47. The imputed value of assigned life insurance is considered a gift and will be

charged against the lifetime allowable exclusion.

• Rev. Rul. 79–231. If the employer changes insurance carriers, a three-year period must be

completed before the change of an assigned policy becomes effective.

• Rev. Rul. 80–239. Assignment of life insurance is not affected by an employer changing

insurance carriers. This reversed Rev. Rul. 79–231.

• Rev. Rul. 81–198. Transfer of ownership rights of a split-dollar insurance policy to a third per-

son triggers a gift tax equal to the terminal value plus unearned premiums less the employer’s

dollar rights to the policy. Annual gift tax is based on the executive’s economic benefit increase

plus premiums paid.

• Rev. Rul. 86–109. Compensation paid to the estate of a deceased employee for services

performed is not considered income for tax purposes and is therefore not subject to tax

withholding. However, FICA will apply for payments in same year as death.

• Rev. Rul. 03–105. Taxpayers may continue to rely on revenue rulings issued before September

17, 2003, if the split-dollar life insurance agreement was entered into on or before that date.

Source: U.S. Internal Revenue Service