Page 756 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 756

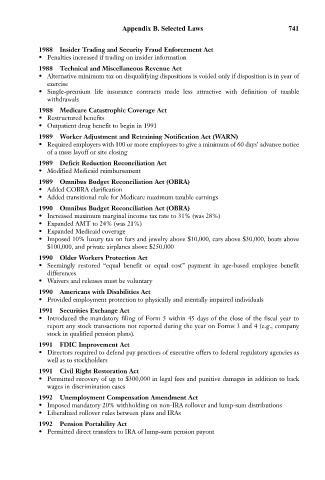

Appendix B. Selected Laws 741

1988 Insider Trading and Security Fraud Enforcement Act

• Penalties increased if trading on insider information

1988 Technical and Miscellaneous Revenue Act

• Alternative minimum tax on disqualifying dispositions is voided only if disposition is in year of

exercise

• Single-premium life insurance contracts made less attractive with definition of taxable

withdrawals

1988 Medicare Catastrophic Coverage Act

• Restructured benefits

• Outpatient drug benefit to begin in 1991

1989 Worker Adjustment and Retraining Notification Act (WARN)

• Required employers with 100 or more employees to give a minimum of 60 days’ advance notice

of a mass layoff or site closing

1989 Deficit Reduction Reconciliation Act

• Modified Medicaid reimbursement

1989 Omnibus Budget Reconciliation Act (OBRA)

• Added COBRA clarification

• Added transitional rule for Medicare maximum taxable earnings

1990 Omnibus Budget Reconciliation Act (OBRA)

• Increased maximum marginal income tax rate to 31% (was 28%)

• Expanded AMT to 24% (was 21%)

• Expanded Medicaid coverage

• Imposed 10% luxury tax on furs and jewelry above $10,000, cars above $30,000, boats above

$100,000, and private airplanes above $250,000

1990 Older Workers Protection Act

• Seemingly restored “equal benefit or equal cost” payment in age-based employee benefit

differences

• Waivers and releases must be voluntary

1990 Americans with Disabilities Act

• Provided employment protection to physically and mentally impaired individuals

1991 Securities Exchange Act

• Introduced the mandatory filing of Form 5 within 45 days of the close of the fiscal year to

report any stock transactions not reported during the year on Forms 3 and 4 (e.g., company

stock in qualified pension plans).

1991 FDIC Improvement Act

• Directors required to defend pay practices of executive offers to federal regulatory agencies as

well as to stockholders

1991 Civil Right Restoration Act

• Permitted recovery of up to $300,000 in legal fees and punitive damages in addition to back

wages in discrimination cases

1992 Unemployment Compensation Amendment Act

• Imposed mandatory 20% withholding on non-IRA rollover and lump-sum distributions

• Liberalized rollover rules between plans and IRAs

1992 Pension Portability Act

• Permitted direct transfers to IRA of lump-sum pension payout