Page 753 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 753

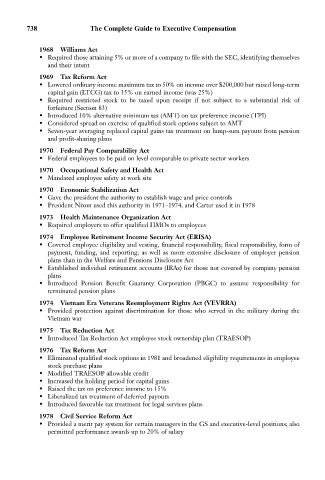

738 The Complete Guide to Executive Compensation

1968 Williams Act

• Required those attaining 5% or more of a company to file with the SEC, identifying themselves

and their intent

1969 Tax Reform Act

• Lowered ordinary income maximum tax to 50% on income over $200,000 but raised long-term

capital gain (LTCG) tax to 35% on earned income (was 25%)

• Required restricted stock to be taxed upon receipt if not subject to a substantial risk of

forfeiture (Section 83)

• Introduced 10% alternative minimum tax (AMT) on tax preference income (TPI)

• Considered spread on exercise of qualified stock options subject to AMT

• Seven-year averaging replaced capital gains tax treatment on lump-sum payouts from pension

and profit-sharing plans

1970 Federal Pay Comparability Act

• Federal employees to be paid on level comparable to private sector workers

1970 Occupational Safety and Health Act

• Mandated employee safety at work site

1970 Economic Stabilization Act

• Gave the president the authority to establish wage and price controls

• President Nixon used this authority in 1971–1974, and Carter used it in 1978

1973 Health Maintenance Organization Act

• Required employers to offer qualified HMOs to employees

1974 Employee Retirement Income Security Act (ERISA)

• Covered employee eligibility and vesting, financial responsibility, fiscal responsibility, form of

payment, funding, and reporting, as well as more extensive disclosure of employer pension

plans than in the Welfare and Pensions Disclosure Act

• Established individual retirement accounts (IRAs) for those not covered by company pension

plans

• Introduced Pension Benefit Guaranty Corporation (PBGC) to assume responsibility for

terminated pension plans

1974 Vietnam Era Veterans Reemployment Rights Act (VEVRRA)

• Provided protection against discrimination for those who served in the military during the

Vietnam war

1975 Tax Reduction Act

• Introduced Tax Reduction Act employee stock ownership plan (TRAESOP)

1976 Tax Reform Act

• Eliminated qualified stock options in 1981 and broadened eligibility requirements in employee

stock purchase plans

• Modified TRAESOP allowable credit

• Increased the holding period for capital gains

• Raised the tax on preference income to 15%

• Liberalized tax treatment of deferred payouts

• Introduced favorable tax treatment for legal services plans

1978 Civil Service Reform Act

• Provided a merit pay system for certain managers in the GS and executive-level positions; also

permitted performance awards up to 20% of salary