Page 151 - The Green Building Bottom Line The Real Cost of Sustainable Building

P. 151

130 CHAPTER 4

ears

Y Years 0 1 2 3

REVENUES

REVENUES

Shaping values, chapter 1 21,300 21,300 21,300

21,300

Shaping values, chapter 1

21,300

21,300

Creating a culture of grreen glue, chapter 2 2 79,000 79,000 79,000

79,000

glue,

chapter

eo

eating

fg

79,000

79,000

een

a

cultur

om

chapter

inside

Green from the inside out, chapter 3 3 3,300 3,300 3,300

the

out,

een

fr

3,300

3,300

3,300

Developing expertise in LEED, chapter 4

Developing expertise in LEED, chapter 4 0 0 0 0

Sale of Green, Inc.

Sale of Gr een, Inc.

103,600

Total Revenues 103,600 103,600 103,600

103,600

otal

103,600

Revenues

EXPENSES

EXPENSES

Shaping values, chapter 1 (166,000) (1 (114,500) (91,875) (97,286)

(166,000)

(91,875)

Shaping values, chapter 1

14,500)

(97,286)

a

eo

eating

(57,600)

chapter

(72,717)

(64,631)

glue,

Creating a culture of grreen glue, chapter 2 2 0 (57,600) (64,631) (72,717)

cultur

een

fg

(78,490)

(22,381)

(22,998)

chapter

the

inside

out,

een

Green from the inside out, chapter 3 3 0 (78,490) (22,381) (22,998)

fr

om

in

(49,000)

(150,000)

LEED,

(417,000)

Developing expertise in LEED, chapter 4 4 (49,000) (150,000) (417,000) (890,000)

Developing

expertise

(890,000)

chapter

(400,590)

(215,000)

(1,083,002)

Total Expenses (215,000) (400,590) (595,888) (1,083,002)

otal

Expenses

(595,888)

(492,288)

Cashflow

(296,990)

(979,402)

Total Cashflow (215,000) (296,990) (492,288) (979,402)

otal

(215,000)

0.909

Discount

Factor

Discount Factor 1.000 0.909 0.826 0.751

0.826

0.751

1.000

(406,849)

(735,839)

PV

Cashflow

(269,991)

(215,000)

PV Cashflow (215,000) (269,991) (406,849) (735,839)

NPV

2,300,994

NPV 2,300,994

IRR

28.38%

IRR 28.38%

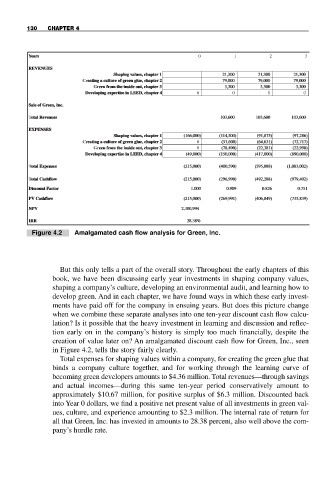

Figure 4.2 Amalgamated cash flow analysis for Green, Inc.

But this only tells a part of the overall story. Throughout the early chapters of this

book, we have been discussing early year investments in shaping company values,

shaping a company’s culture, developing an environmental audit, and learning how to

develop green. And in each chapter, we have found ways in which these early invest-

ments have paid off for the company in ensuing years. But does this picture change

when we combine these separate analyses into one ten-year discount cash flow calcu-

lation? Is it possible that the heavy investment in learning and discussion and reflec-

tion early on in the company’s history is simply too much financially, despite the

creation of value later on? An amalgamated discount cash flow for Green, Inc., seen

in Figure 4.2, tells the story fairly clearly.

Total expenses for shaping values within a company, for creating the green glue that

binds a company culture together, and for working through the learning curve of

becoming green developers amounts to $4.36 million. Total revenues—through savings

and actual incomes—during this same ten-year period conservatively amount to

approximately $10.67 million, for positive surplus of $6.3 million. Discounted back

into Year 0 dollars, we find a positive net present value of all investments in green val-

ues, culture, and experience amounting to $2.3 million. The internal rate of return for

all that Green, Inc. has invested in amounts to 28.38 percent, also well above the com-

pany’s hurdle rate.