Page 51 - The Green Building Bottom Line The Real Cost of Sustainable Building

P. 51

30 CHAPTER 1

Y Years 0 1 2 3

ears

COSTS

COSTS

(150,000)

Opportunity

Lost

(3,61

(22,500)

(3,375)

Lost Opportunity (150,000) (22,500) (3,375) (3,611)

1)

(16,000)

Facilitator

Facilitator (16,000)

Sub-total Costs (166,000) (22,500) (3,375) (3,61 1)

(22,500)

(3,611)

(166,000)

(3,375)

Sub-total Costs

(22,500)

(3,375)

Total Cashflowotal Cashflow (166,000) (22,500) (3,375) (3,61 1)

(166,000)

(3,611)

0.909

0.826

1.000

0.751

Discount Factor 1.000 0.909 0.826 0.751

Discount Factor

PV

(166,000)

PV Cashflow (166,000) (20,455) (2,789) (2,713)

(2,789)

(20,455)

Cashflow

(2,713)

NPV (208,987)

NPV

(208,987)

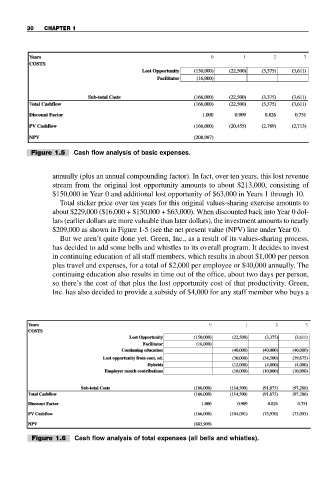

Figure 1.5 Cash flow analysis of basic expenses.

annually (plus an annual compounding factor). In fact, over ten years, this lost revenue

stream from the original lost opportunity amounts to about $213,000, consisting of

$150,000 in Year 0 and additional lost opportunity of $63,000 in Years 1 through 10.

Total sticker price over ten years for this original values-sharing exercise amounts to

about $229,000 ($16,000 + $150,000 + $63,000). When discounted back into Year 0 dol-

lars (earlier dollars are more valuable than later dollars), the investment amounts to nearly

$209,000 as shown in Figure 1-5 (see the net present value (NPV) line under Year 0).

But we aren’t quite done yet. Green, Inc., as a result of its values-sharing process,

has decided to add some bells and whistles to its overall program. It decides to invest

in continuing education of all staff members, which results in about $1,000 per person

plus travel and expenses, for a total of $2,000 per employee or $40,000 annually. The

continuing education also results in time out of the office, about two days per person,

so there’s the cost of that plus the lost opportunity cost of that productivity. Green,

Inc. has also decided to provide a subsidy of $4,000 for any staff member who buys a

Y Years 0 1 2 3

ears

COSTS

COSTS

1)

(22,500)

(150,000)

Lost

Opportunity

Lost Opportunity (150,000) (22,500) (3,375) (3,611)

(3,375)

(3,61

Facilitator (16,000)

(16,000)

Facilitator

Continuing education

Continuing education (40,000) (40,000) (40,000)

(40,000)

(40,000)

(40,000)

Lost opportunity from cont. ed.

Lost opportunity fr om cont. ed. (30,000) (34,500) (39,675)

(34,500)

(39,675)

(30,000)

(4,000)

(4,000)

(12,000)

Hybrids (12,000) (4,000) (4,000)

Hybrids

(10,000)

match

(10,000)

Employer match contributionscontributions (10,000) (10,000) (10,000)

Employer

(10,000)

Costs

14,500)

(97,286)

Sub-total Costs (166,000) (1 (114,500) (91,875) (97,286)

Sub-total

(91,875)

(166,000)

Total Cashflowotal Cashflow (166,000) (1 (114,500) (91,875) (97,286)

(97,286)

(166,000)

14,500)

(91,875)

Discount Factor 1.000 0.909 0.826 0.751

Discount Factor

0.751

0.826

0.909

1.000

PV (166,000) (104,091) (75,930) (73,093)

(73,093)

PV CashflowCashflow

(75,930)

(104,091)

(166,000)

(883,909)

NPV

NPV (883,909)

Figure 1.6 Cash flow analysis of total expenses (all bells and whistles).