Page 315 - Fluid Power Engineering

P. 315

Financial Modeling of W ind Projects 281

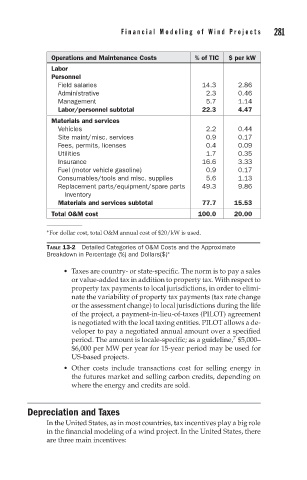

Operations and Maintenance Costs %ofTIC $ per kW

Labor

Personnel

Field salaries 14.3 2.86

Administrative 2.3 0.46

Management 5.7 1.14

Labor/personnel subtotal 22.3 4.47

Materials and services

Vehicles 2.2 0.44

Site maint/misc. services 0.9 0.17

Fees, permits, licenses 0.4 0.09

Utilities 1.7 0.35

Insurance 16.6 3.33

Fuel (motor vehicle gasoline) 0.9 0.17

Consumables/tools and misc. supplies 5.6 1.13

Replacement parts/equipment/spare parts 49.3 9.86

Inventory

Materials and services subtotal 77.7 15.53

Total O&M cost 100.0 20.00

∗ For dollar cost, total O&M annual cost of $20/kW is used.

TABLE 13-2 Detailed Categories of O&M Costs and the Approximate

Breakdown in Percentage (%) and Dollars($) ∗

Taxes are country- or state-specific. The norm is to pay a sales

or value-added tax in addition to property tax. With respect to

property tax payments to local jurisdictions, in order to elimi-

nate the variability of property tax payments (tax rate change

or the assessment change) to local jurisdictions during the life

of the project, a payment-in-lieu-of-taxes (PILOT) agreement

is negotiated with the local taxing entities. PILOT allows a de-

veloper to pay a negotiated annual amount over a specified

7

period. The amount is locale-specific; as a guideline, $5,000–

$6,000 per MW per year for 15-year period may be used for

US-based projects.

Other costs include transactions cost for selling energy in

the futures market and selling carbon credits, depending on

where the energy and credits are sold.

Depreciation and Taxes

In the United States, as in most countries, tax incentives play a big role

in the financial modeling of a wind project. In the United States, there

are three main incentives: