Page 336 - Fluid Power Engineering

P. 336

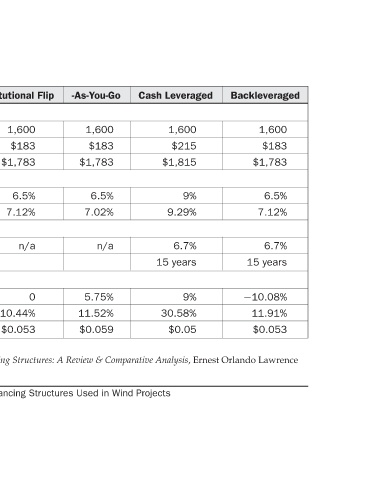

Backleveraged 1,600 $183 $1,783 6.5% 7.12% 6.7% years 15 −10.08% 11.91% $0.053

Leveraged 1,600 $215 $1,815 9% 9.29% 6.7% years 9% 30.58% $0.05

Cash 15 Projects

Wind

-As-You-Go 1,600 $183 $1,783 6.5% 7.02% n/a 5.75% 11.52% $0.059 in Used

Flip n/a 0 Structures

Institutional 1,600 $183 $1,783 6.5% 7.12% 10.44% $0.053 Source: LBL. Harper, J. P. Karcher, M. D., Bolinger, M. Wind Project Financing Structures: A Review & Comparative Analysis, Ernest Orlando Lawrence Financing

Various

Flip n/a of

Strategic 1,600 $183 $1,783 6.5% 7.02% 6.5% 37.44% $0.061 Performance

Corporate $1,600 $125 $1,725 n/a n/a n/a 6.64% 10% $0.063 Financial

return return Berkeley National Laboratory, Berkeley, CA, 2007. LBNL-63434. and

tax IRR Computed tax kWh Assumptions

cost

assumptions cost installed after investor Target IRR, assumptions rate after IRR IRR per LCOE

Cost Hard cost Soft Total Tax 10-year 20-year Debt Interest Maturity Developer 10-year 20-year 20-year 13-12 TABLE

296