Page 333 - Fluid Power Engineering

P. 333

294 Chapter Thirteen

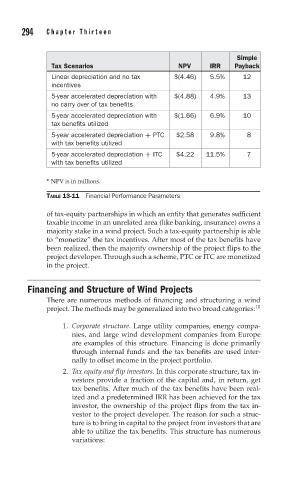

Simple

Tax Scenarios NPV IRR Payback

Linear depreciation and no tax $(4.46) 5.5% 12

incentives

5-year accelerated depreciation with $(4.88) 4.9% 13

no carry over of tax benefits

5-year accelerated depreciation with $(1.66) 6.9% 10

tax benefits utilized

5-year accelerated depreciation + PTC $2.58 9.8% 8

with tax benefits utilized

5-year accelerated depreciation + ITC $4.22 11.5% 7

with tax benefits utilized

∗ NPV is in millions.

TABLE 13-11 Financial Performance Parameters

of tax-equity partnerships in which an entity that generates sufficient

taxable income in an unrelated area (like banking, insurance) owns a

majority stake in a wind project. Such a tax-equity partnership is able

to “monetize” the tax incentives. After most of the tax benefits have

been realized, then the majority ownership of the project flips to the

project developer. Through such a scheme, PTC or ITC are monetized

in the project.

Financing and Structure of Wind Projects

There are numerous methods of financing and structuring a wind

project. The methods may be generalized into two broad categories: 10

1. Corporate structure. Large utility companies, energy compa-

nies, and large wind development companies from Europe

are examples of this structure. Financing is done primarily

through internal funds and the tax benefits are used inter-

nally to offset income in the project portfolio.

2. Tax equity and flip investors. In this corporate structure, tax in-

vestors provide a fraction of the capital and, in return, get

tax benefits. After much of the tax benefits have been real-

ized and a predetermined IRR has been achieved for the tax

investor, the ownership of the project flips from the tax in-

vestor to the project developer. The reason for such a struc-

ture is to bring in capital to the project from investors that are

able to utilize the tax benefits. This structure has numerous

variations: