Page 32 - A Comprehensive Guide to Solar Energy Systems

P. 32

26 A COMPrEHENSIVE GUIDE TO SOlAr ENErGY SYSTEMS

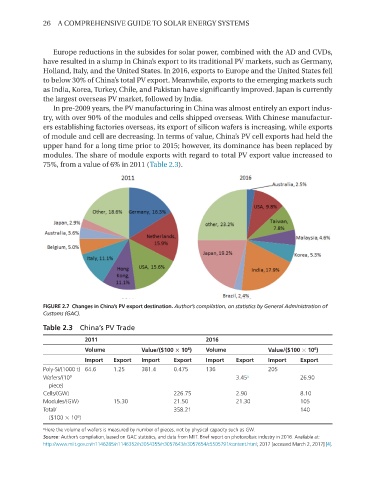

Europe reductions in the subsides for solar power, combined with the AD and CVDs,

have resulted in a slump in China’s export to its traditional PV markets, such as Germany,

Holland, Italy, and the United States. In 2016, exports to Europe and the United States fell

to below 30% of China’s total PV export. Meanwhile, exports to the emerging markets such

as India, Korea, Turkey, Chile, and Pakistan have significantly improved. Japan is currently

the largest overseas PV market, followed by India.

In pre-2009 years, the PV manufacturing in China was almost entirely an export indus-

try, with over 90% of the modules and cells shipped overseas. With Chinese manufactur-

ers establishing factories overseas, its export of silicon wafers is increasing, while exports

of module and cell are decreasing. In terms of value, China’s PV cell exports had held the

upper hand for a long time prior to 2015; however, its dominance has been replaced by

modules. The share of module exports with regard to total PV export value increased to

75%, from a value of 6% in 2011 (Table 2.3).

FIGURE 2.7 Changes in China’s PV export destination. Author’s compilation, on statistics by General Administration of

Customs (GAC).

Table 2.3 China’s PV Trade

2011 2016

Volume Value/($100 × 10 ) Volume Value/($100 × 10 )

6

6

Import Export Import Export Import Export Import Export

Poly-Si/(1000 t) 64.6 1.25 381.4 0.475 136 205

9

Wafers/(10 3.45 a 26.90

piece)

Cells/(GW) 226.75 2.90 8.10

Modules/(GW) 15.30 21.50 21.30 105

Total/ 358.21 140

($100 × 10 )

6

a Here the volume of wafers is measured by number of pieces, not by physical capacity such as GW.

Source: Author’s compilation, based on GAC statistics, and data from MIIT. Brief report on photovoltaic industry in 2016. Available at:

http://www.miit.gov.cn/n1146285/n1146352/n3054355/n3057643/n3057654/c5505791/content.html; 2017 [accessed March 2, 2017] [4].