Page 45 - A Comprehensive Guide to Solar Energy Systems

P. 45

40 A COMPREHEnSIVE GUIDE TO SOLAR EnERGy SySTEMS

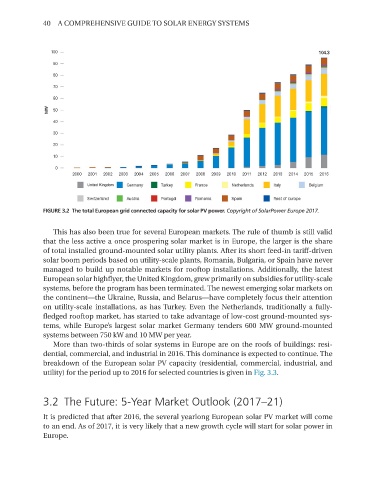

FIGURE 3.2 The total European grid connected capacity for solar PV power. Copyright of SolarPower Europe 2017.

This has also been true for several European markets. The rule of thumb is still valid

that the less active a once prospering solar market is in Europe, the larger is the share

of total installed ground-mounted solar utility plants. After its short feed-in tariff- driven

solar boom periods based on utility-scale plants, Romania, Bulgaria, or Spain have never

managed to build up notable markets for rooftop installations. Additionally, the latest

European solar highflyer, the United Kingdom, grew primarily on subsidies for utility-scale

systems, before the program has been terminated. The newest emerging solar markets on

the continent—the Ukraine, Russia, and Belarus—have completely focus their attention

on utility-scale installations, as has Turkey. Even the netherlands, traditionally a fully-

fledged rooftop market, has started to take advantage of low-cost ground-mounted sys-

tems, while Europe’s largest solar market Germany tenders 600 MW ground-mounted

systems between 750 kW and 10 MW per year.

More than two-thirds of solar systems in Europe are on the roofs of buildings: resi-

dential, commercial, and industrial in 2016. This dominance is expected to continue. The

breakdown of the European solar PV capacity (residential, commercial, industrial, and

utility) for the period up to 2016 for selected countries is given in Fig. 3.3.

3.2 The Future: 5-Year Market Outlook (2017–21)

It is predicted that after 2016, the several yearlong European solar PV market will come

to an end. As of 2017, it is very likely that a new growth cycle will start for solar power in

Europe.