Page 50 - A Comprehensive Guide to Solar Energy Systems

P. 50

Chapter 3 • Solar Power in Europe: Status and Outlook 45

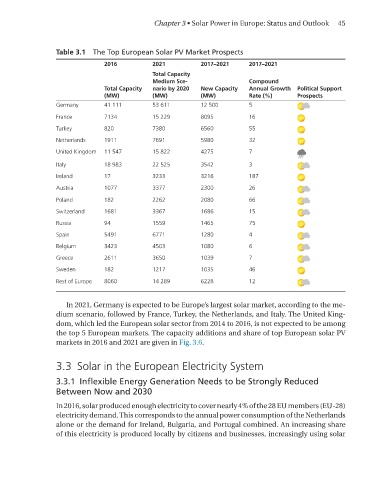

Table 3.1 The Top European Solar PV Market Prospects

2016 2021 2017–2021 2017–2021

Total Capacity

Medium Sce- Compound

Total Capacity nario by 2020 New Capacity Annual Growth Political Support

(MW) (MW) (MW) Rate (%) Prospects

Germany 41 111 53 611 12 500 5

France 7134 15 229 8095 16

Turkey 820 7380 6560 55

Netherlands 1911 7691 5980 32

United Kingdom 11 547 15 822 4275 7

Italy 18 983 22 525 3542 3

Ireland 17 3233 3216 187

Austria 1077 3377 2300 26

Poland 182 2262 2080 66

Switzerland 1681 3367 1686 15

Russia 94 1559 1465 75

Spain 5491 6771 1280 4

Belgium 3423 4503 1080 6

Greece 2611 3650 1039 7

Sweden 182 1217 1035 46

Rest of Europe 8060 14 289 6228 12

In 2021, Germany is expected to be Europe’s largest solar market, according to the me-

dium scenario, followed by France, Turkey, the netherlands, and Italy. The United King-

dom, which led the European solar sector from 2014 to 2016, is not expected to be among

the top 5 European markets. The capacity additions and share of top European solar PV

markets in 2016 and 2021 are given in Fig. 3.6.

3.3 Solar in the European Electricity System

3.3.1 Inflexible Energy Generation Needs to be Strongly Reduced

Between Now and 2030

In 2016, solar produced enough electricity to cover nearly 4% of the 28 EU members (EU-28)

electricity demand. This corresponds to the annual power consumption of the netherlands

alone or the demand for Ireland, Bulgaria, and Portugal combined. An increasing share

of this electricity is produced locally by citizens and businesses, increasingly using solar