Page 49 - A Comprehensive Guide to Solar Energy Systems

P. 49

44 A COMPREHEnSIVE GUIDE TO SOLAR EnERGy SySTEMS

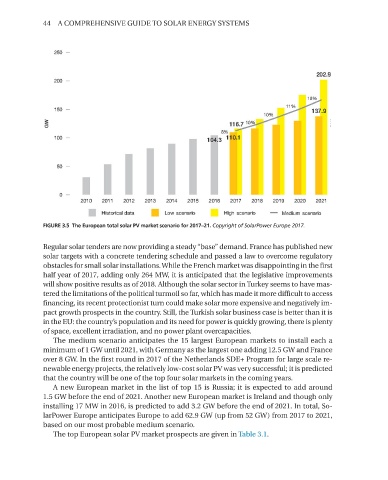

FIGURE 3.5 The European total solar PV market scenario for 2017–21. Copyright of SolarPower Europe 2017.

Regular solar tenders are now providing a steady “base” demand. France has published new

solar targets with a concrete tendering schedule and passed a law to overcome regulatory

obstacles for small solar installations. While the French market was disappointing in the first

half year of 2017, adding only 264 MW, it is anticipated that the legislative improvements

will show positive results as of 2018. Although the solar sector in Turkey seems to have mas-

tered the limitations of the political turmoil so far, which has made it more difficult to access

financing, its recent protectionist turn could make solar more expensive and negatively im-

pact growth prospects in the country. Still, the Turkish solar business case is better than it is

in the EU: the country’s population and its need for power is quickly growing, there is plenty

of space, excellent irradiation, and no power plant overcapacities.

The medium scenario anticipates the 15 largest European markets to install each a

minimum of 1 GW until 2021, with Germany as the largest one adding 12.5 GW and France

over 8 GW. In the first round in 2017 of the netherlands SDE+ Program for large scale re-

newable energy projects, the relatively low-cost solar PV was very successful; it is predicted

that the country will be one of the top four solar markets in the coming years.

A new European market in the list of top 15 is Russia; it is expected to add around

1.5 GW before the end of 2021. Another new European market is Ireland and though only

installing 17 MW in 2016, is predicted to add 3.2 GW before the end of 2021. In total, So-

larPower Europe anticipates Europe to add 62.9 GW (up from 52 GW) from 2017 to 2021,

based on our most probable medium scenario.

The top European solar PV market prospects are given in Table 3.1.