Page 75 - A Comprehensive Guide to Solar Energy Systems

P. 75

70 A COmPrEHENSIVE GUIDE TO SOlAr ENErGy SySTEmS

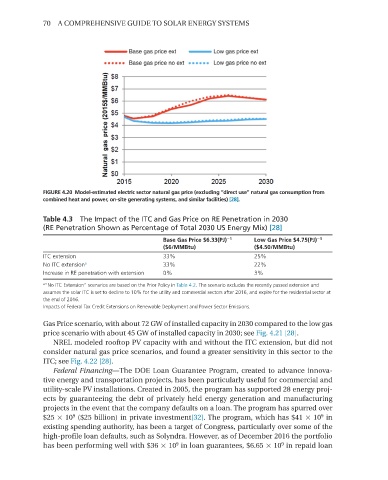

FIGURE 4.20 Model-estimated electric sector natural gas price (excluding “direct use” natural gas consumption from

combined heat and power, on-site generating systems, and similar facilities) [28].

Table 4.3 The Impact of the ITC and Gas Price on RE Penetration in 2030

(RE Penetration Shown as Percentage of Total 2030 US Energy Mix) [28]

−1

Base Gas Price $6.33(PJ) Low Gas Price $4.75(PJ)

−1

($6/MMBtu) ($4.50/MMBtu)

ITC extension 33% 25%

No ITC extension a 33% 22%

Increase in RE penetration with extension 0% 3%

a “No ITC Extension” scenarios are based on the Prior Policy in Table 4.2. The scenario excludes the recently passed extension and

assumes the solar ITC is set to decline to 10% for the utility and commercial sectors after 2016, and expire for the residential sector at

the end of 2016.

Impacts of Federal Tax Credit Extensions on Renewable Deployment and Power Sector Emissions.

Gas Price scenario, with about 72 GW of installed capacity in 2030 compared to the low gas

price scenario with about 45 GW of installed capacity in 2030; see Fig. 4.21 [28].

NrEl modeled rooftop PV capacity with and without the ITC extension, but did not

consider natural gas price scenarios, and found a greater sensitivity in this sector to the

ITC; see Fig. 4.22 [28].

Federal Financing—The DOE Loan Guarantee Program, created to advance innova-

tive energy and transportation projects, has been particularly useful for commercial and

utility-scale PV installations. Created in 2005, the program has supported 28 energy proj-

ects by guaranteeing the debt of privately held energy generation and manufacturing

projects in the event that the company defaults on a loan. The program has spurred over

9

$25 × 10 ($25 billion) in private investment[32]. The program, which has $41 × 10 in

9

existing spending authority, has been a target of Congress, particularly over some of the

high-profile loan defaults, such as Solyndra. However, as of December 2016 the portfolio

9

9

has been performing well with $36 × 10 in loan guarantees, $6.65 × 10 in repaid loan