Page 545 -

P. 545

OTHER SIMULATION ISSUES 525

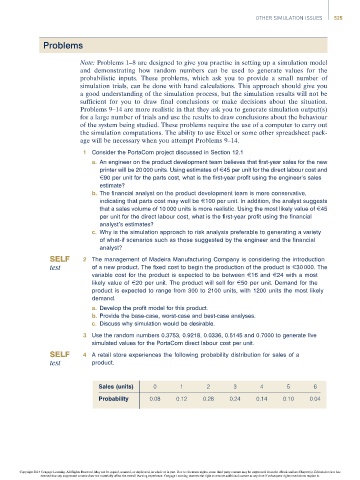

Problems

Note: Problems 1–8 are designed to give you practise in setting up a simulation model

and demonstrating how random numbers can be used to generate values for the

probabilistic inputs. These problems, which ask you to provide a small number of

simulation trials, can be done with hand calculations. This approach should give you

a good understanding of the simulation process, but the simulation results will not be

sufficient for you to draw final conclusions or make decisions about the situation.

Problems 9–14 are more realistic in that they ask you to generate simulation output(s)

for a large number of trials and use the results to draw conclusions about the behaviour

of the system being studied. These problems require the use of a computer to carry out

the simulation computations. The ability to use Excel or some other spreadsheet pack-

age will be necessary when you attempt Problems 9–14.

1 Consider the PortaCom project discussed in Section 12.1

a. An engineer on the product development team believes that first-year sales for the new

printer will be 20 000 units. Using estimates of E45 per unit for the direct labour cost and

E90 per unit for the parts cost, what is the first-year profit using the engineer’s sales

estimate?

b. The financial analyst on the product development team is more conservative,

indicating that parts cost may well be E100 per unit. In addition, the analyst suggests

that a sales volume of 10 000 units is more realistic. Using the most likely value of E45

per unit for the direct labour cost, what is the first-year profit using the financial

analyst’s estimates?

c. Why is the simulation approach to risk analysis preferable to generating a variety

of what-if scenarios such as those suggested by the engineer and the financial

analyst?

2 The management of Madeira Manufacturing Company is considering the introduction

of a new product. The fixed cost to begin the production of the product is E30 000. The

variable cost for the product is expected to be between E16 and E24 with a most

likely value of E20 per unit. The product will sell for E50 per unit. Demand for the

product is expected to range from 300 to 2100 units, with 1200 units the most likely

demand.

a. Develop the profit model for this product.

b. Provide the base-case, worst-case and best-case analyses.

c. Discuss why simulation would be desirable.

3 Use the random numbers 0.3753, 0.9218, 0.0336, 0.5145 and 0.7000 to generate five

simulated values for the PortaCom direct labour cost per unit.

4 A retail store experiences the following probability distribution for sales of a

product.

Sales (units) 0 1 2 3 4 5 6

Probability 0.08 0.12 0.28 0.24 0.14 0.10 0.04

Copyright 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part. Due to electronic rights, some third party content may be suppressed from the eBook and/or eChapter(s). Editorial review has

deemed that any suppressed content does not materially affect the overall learning experience. Cengage Learning reserves the right to remove additional content at any time if subsequent rights restrictions require it.