Page 424 - Design for Six Sigma for Service (Six SIGMA Operational Methods)

P. 424

382 Chapter Ten

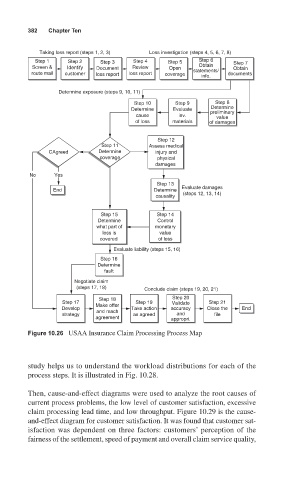

Taking loss report (steps 1, 2, 3) Loss investigation (steps 4, 5, 6, 7, 8)

Step 1 Step 2 Step 3 Step 4 Step 5 Step 6 Step 7

Screen & Identify Document Review Open Obtain Obtain

route mail customer loss report loss report coverage statements/ documents

info.

Determine exposure (steps 9, 10, 11)

Step 10 Step 9 Step 8

Determine

Determine Evaluate preliminary

cause inv. value

of loss materials of damages

Step 12

Step 11 Assess medical

CAgreed Determine injury and

coverage physical

damages

No Yes

Step 13

End Determine Evaluate damages

causality (steps 12, 13, 14)

Step 15 Step 14

Determine Control

what part of monetary

loss is value

covered of loss

Evaluate liability (steps 15, 16)

Step 16

Determine

fault

Negotiate claim

(steps 17, 18)

Conclude claim (steps 19, 20, 21)

Step 18 Step 20

Step 17 Step 19 Validate Step 21

Develop Make offer Take action accuracy Close the End

and reach

strategy as agreed and file

agreement appropri.

Figure 10.26 USAA Insurance Claim Processing Process Map

study helps us to understand the workload distributions for each of the

process steps. It is illustrated in Fig. 10.28.

Then, cause-and-effect diagrams were used to analyze the root causes of

current process problems, the low level of customer satisfaction, excessive

claim processing lead time, and low throughput. Figure 10.29 is the cause-

and-effect diagram for customer satisfaction. It was found that customer sat-

isfaction was dependent on three factors: customers’ perception of the

fairness of the settlement, speed of payment and overall claim service quality,