Page 124 - Finance for Non-Financial Managers

P. 124

Siciliano07.qxd 3/20/2003 11:23 AM Page 105

Critical Performance Factors

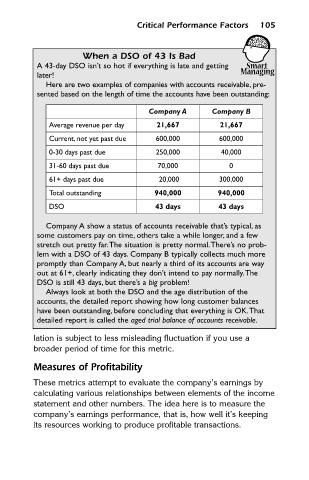

A 43-day DSO isn’t so hot if everything is late and getting

later! When a DSO of 43 Is Bad 105

Here are two examples of companies with accounts receivable, pre-

sented based on the length of time the accounts have been outstanding:

Company A Company B

Average revenue per day 21,667 21,667

Current, not yet past due 600,000 600,000

0-30 days past due 250,000 40,000

31-60 days past due 70,000 0

61+ days past due 20,000 300,000

Total outstanding 940,000 940,000

DSO 43 days 43 days

Company A show a status of accounts receivable that’s typical, as

some customers pay on time, others take a while longer, and a few

stretch out pretty far.The situation is pretty normal.There’s no prob-

lem with a DSO of 43 days. Company B typically collects much more

promptly than Company A, but nearly a third of its accounts are way

out at 61+, clearly indicating they don’t intend to pay normally.The

DSO is still 43 days, but there’s a big problem!

Always look at both the DSO and the age distribution of the

accounts, the detailed report showing how long customer balances

have been outstanding, before concluding that everything is OK.That

detailed report is called the aged trial balance of accounts receivable.

lation is subject to less misleading fluctuation if you use a

broader period of time for this metric.

Measures of Profitability

These metrics attempt to evaluate the company’s earnings by

calculating various relationships between elements of the income

statement and other numbers. The idea here is to measure the

company’s earnings performance, that is, how well it’s keeping

its resources working to produce profitable transactions.