Page 415 - Global Project Management Handbook

P. 415

20-4 MANAGEMENT OF THE PROJECT-ORIENTED COMPANY

RISK SHARING ON CONTRACTS

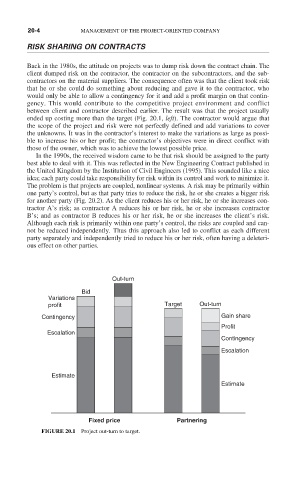

Back in the 1980s, the attitude on projects was to dump risk down the contract chain. The

client dumped risk on the contractor, the contractor on the subcontractors, and the sub-

contractors on the material suppliers. The consequence often was that the client took risk

that he or she could do something about reducing and gave it to the contractor, who

would only be able to allow a contingency for it and add a profit margin on that contin-

gency. This would contribute to the competitive project environment and conflict

between client and contractor described earlier. The result was that the project usually

ended up costing more than the target (Fig. 20.1, left). The contractor would argue that

the scope of the project and risk were not perfectly defined and add variations to cover

the unknowns. It was in the contractor’s interest to make the variations as large as possi-

ble to increase his or her profit; the contractor’s objectives were in direct conflict with

those of the owner, which was to achieve the lowest possible price.

In the 1990s, the received wisdom came to be that risk should be assigned to the party

best able to deal with it. This was reflected in the New Engineering Contract published in

the United Kingdom by the Institution of Civil Engineers (1995). This sounded like a nice

idea; each party could take responsibility for risk within its control and work to minimize it.

The problem is that projects are coupled, nonlinear systems. A risk may be primarily within

one party’s control, but as that party tries to reduce the risk, he or she creates a bigger risk

for another party (Fig. 20.2). As the client reduces his or her risk, he or she increases con-

tractor A’s risk; as contractor A reduces his or her risk, he or she increases contractor

B’s; and as contractor B reduces his or her risk, he or she increases the client’s risk.

Although each risk is primarily within one party’s control, the risks are coupled and can-

not be reduced independently. Thus this approach also led to conflict as each different

party separately and independently tried to reduce his or her risk, often having a deleteri-

ous effect on other parties.

Out-turn

Bid

Variations

profit Target Out-turn

Contingency Gain share

Profit

Escalation

Contingency

Escalation

Estimate

Estimate

Fixed price Partnering

FIGURE 20.1 Project out-turn to target.