Page 358 - Hydrocarbon Exploration and Production Second Edition

P. 358

Petroleum Economics 345

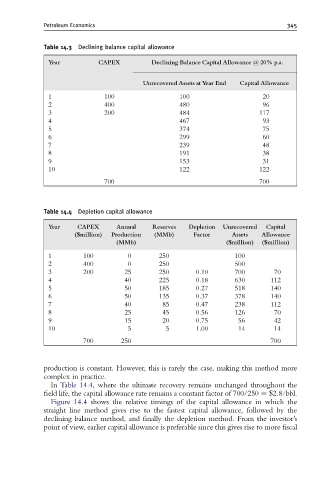

Table 14.3 Declining balance capital allowance

Year CAPEX Declining Balance Capital Allowance @ 20% p.a.

Unrecovered Assets atYear End Capital Allowance

1 100 100 20

2 400 480 96

3 200 484 117

4 467 93

5 374 75

6 299 60

7 239 48

8 191 38

9 153 31

10 122 122

700 700

Table 14.4 Depletion capital allowance

Year CAPEX Annual Reserves Depletion Unrecovered Capital

($million) Production (MMb) Factor Assets Allowance

(MMb) ($million) ($million)

1 100 0 250 100

2 400 0 250 500

3 200 25 250 0.10 700 70

4 40 225 0.18 630 112

5 50 185 0.27 518 140

6 50 135 0.37 378 140

7 40 85 0.47 238 112

8 25 45 0.56 126 70

9 15 20 0.75 56 42

10 5 5 1.00 14 14

700 250 700

production is constant. However, this is rarely the case, making this method more

complex in practice.

In Table 14.4, where the ultimate recovery remains unchanged throughout the

field life, the capital allowance rate remains a constant factor of 700/250 ¼ $2.8/bbl.

Figure 14.4 shows the relative timings of the capital allowance in which the

straight line method gives rise to the fastest capital allowance, followed by the

declining balance method, and finally the depletion method. From the investor’s

point of view, earlier capital allowance is preferable since this gives rise to more fiscal