Page 359 - Hydrocarbon Exploration and Production Second Edition

P. 359

346 Constructing a Project Cashflow

140 straight

120

Capital allowance $m 100 line

80

declining

60

balance

40

20

(UOP)

0 depletion

1 2 3 4 5 6 7 8 9 10

Years

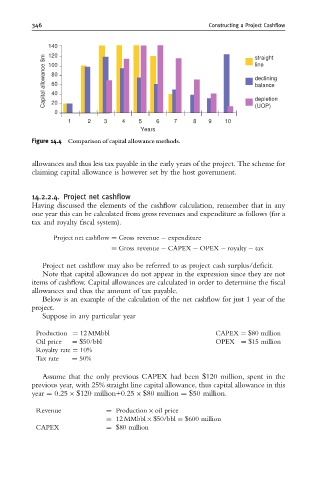

Figure 14.4 Comparison of capital allowance methods.

allowances and thus less tax payable in the early years of the project. The scheme for

claiming capital allowance is however set by the host government.

14.2.2.4. Project net cashflow

Having discussed the elements of the cashflow calculation, remember that in any

one year this can be calculated from gross revenues and expenditure as follows (for a

tax and royalty fiscal system).

Project net cashflow ¼ Gross revenue expenditure

¼ Gross revenue CAPEX OPEX royalty tax

Project net cashflow may also be referred to as project cash surplus/deficit.

Note that capital allowances do not appear in the expression since they are not

items of cashflow. Capital allowances are calculated in order to determine the fiscal

allowances and thus the amount of tax payable.

Below is an example of the calculation of the net cashflow for just 1 year of the

project.

Suppose in any particular year

Production ¼ 12 MMbbl CAPEX ¼ $80 million

Oil price ¼ $50/bbl OPEX ¼ $15 million

Royalty rate ¼ 10%

Tax rate ¼ 50%

Assume that the only previous CAPEX had been $120 million, spent in the

previous year, with 25% straight line capital allowance, thus capital allowance in this

year ¼ 0.25 $120 million+0.25 $80 million ¼ $50 million.

Revenue ¼ Production oil price

¼ 12 MMbbl $50/bbl ¼ $600 million

CAPEX ¼ $80 million