Page 363 - Hydrocarbon Exploration and Production Second Edition

P. 363

350 Constructing a Project Cashflow

60

CT 30% +

SC 20%

50

Royalty off new oil

PRT allowance

PRT SPD doubled PRT zero for new fields CT 30% +

40

Oil Price (MOD US $/bbl) 30 PRT Cross Field SC 20%

70%

PRT 50% existing fields

E&A allowance out

allowance

45%

20

SPD out

APRT + 1/1/03

PRT Royalty

75% abolished for

10 CT reduced

all old fields

to 31%

PRT APRT out Royalty off CT reduced

60% E&A allowance new gas to 30%

0

1970 1971 1972 1973 1974 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005

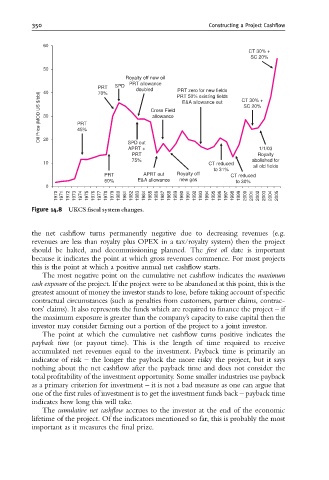

Figure 14.8 UKCS ¢scal system changes.

the net cashflow turns permanently negative due to decreasing revenues (e.g.

revenues are less than royalty plus OPEX in a tax/royalty system) then the project

should be halted, and decommissioning planned. The first oil date is important

because it indicates the point at which gross revenues commence. For most projects

this is the point at which a positive annual net cashflow starts.

The most negative point on the cumulative net cashflow indicates the maximum

cash exposure of the project. If the project were to be abandoned at this point, this is the

greatest amount of money the investor stands to lose, before taking account of specific

contractual circumstances (such as penalties from customers, partner claims, contrac-

tors’ claims). It also represents the funds which are required to finance the project – if

the maximum exposure is greater than the company’s capacity to raise capital then the

investor may consider farming out a portion of the project to a joint investor.

The point at which the cumulative net cashflow turns positive indicates the

payback time (or payout time). This is the length of time required to receive

accumulated net revenues equal to the investment. Payback time is primarily an

indicator of risk – the longer the payback the more risky the project, but it says

nothing about the net cashflow after the payback time and does not consider the

total profitability of the investment opportunity. Some smaller industries use payback

as a primary criterion for investment – it is not a bad measure as one can argue that

one of the first rules of investment is to get the investment funds back – payback time

indicates how long this will take.

The cumulative net cashflow accrues to the investor at the end of the economic

lifetime of the project. Of the indicators mentioned so far, this is probably the most

important as it measures the final prize.