Page 373 - Hydrocarbon Exploration and Production Second Edition

P. 373

360 Incorporating Inflation

100

Production

Oil

Price

50

Total

10% NPV $m Fixed

Opex

Opex

0

Capex

Production

-50

-60 -40 -20 0 +20 +40 +60

% Variation in input parameter

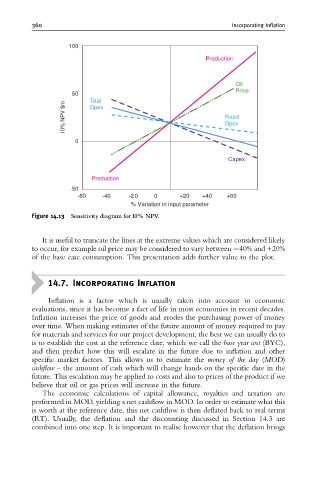

Figure 14.13 Sensitivity diagram for 10% NPV.

It is useful to truncate the lines at the extreme values which are considered likely

to occur, for example oil price may be considered to vary between 40% and +20%

of the base case consumption. This presentation adds further value to the plot.

14.7. Incorporating Inflation

Inflation is a factor which is usually taken into account in economic

evaluations, since it has become a fact of life in most economies in recent decades.

Inflation increases the price of goods and erodes the purchasing power of money

over time. When making estimates of the future amount of money required to pay

for materials and services for our project development, the best we can usually do to

is to establish the cost at the reference date, which we call the base year cost (BYC),

and then predict how this will escalate in the future due to inflation and other

specific market factors. This allows us to estimate the money of the day (MOD)

cashflow – the amount of cash which will change hands on the specific date in the

future. This escalation may be applied to costs and also to prices of the product if we

believe that oil or gas prices will increase in the future.

The economic calculations of capital allowance, royalties and taxation are

performed in MOD, yielding a net cashflow in MOD. In order to estimate what this

is worth at the reference date, this net cashflow is then deflated back to real terms

(RT). Usually, the deflation and the discounting discussed in Section 14.3 are

combined into one step. It is important to realise however that the deflation brings