Page 376 - Hydrocarbon Exploration and Production Second Edition

P. 376

Petroleum Economics 363

performed not simply by scaling, but by tailoring an engineering solution to each

case assuming that we would know the size of reserves before developing the field.

For example, the low case reserves may be developed as a satellite development tied

into existing facilities, whereas the high case reserves might be more economic to

develop using a dedicated drilling and production facility.

We define the EMV of the exploration prospect as

EMV ¼ Unrisked NPV POS PV exploration costs

where POS is the probability of success of an economic development; unrisked NPV

is the mean of the H, M, L NPVs (without any consideration of exploration and

appraisal costs); PVexploration costs are the discounted cost of the exploration activity.

The POS is estimated using the techniques discussed in Chapter 3.

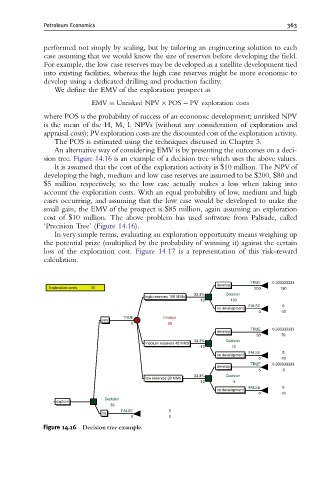

An alternative way of considering EMV is by presenting the outcomes on a deci-

sion tree. Figure 14.16 is an example of a decision tree which uses the above values.

It is assumed that the cost of the exploration activity is $10 million. The NPV of

developing the high, medium and low case reserves are assumed to be $200, $80 and

$5 million respectively, so the low case actually makes a loss when taking into

account the exploration costs. With an equal probability of low, medium and high

cases occurring, and assuming that the low case would be developed to make the

small gain, the EMV of the prospect is $85 million, again assuming an exploration

cost of $10 million. The above problem has used software from Palisade, called

‘Precision Tree’ (Figure 14.16).

In very simple terms, evaluating an exploration opportunity means weighing up

the potential prize (multiplied by the probability of winning it) against the certain

loss of the exploration cost. Figure 14.17 is a representation of this risk-reward

calculation.

TRUE 0.333333333

develop

Exploration costs 10 200 190

33.3% Decision

high reserves 100 MMb

-10 190

FALSE 0

no development

0 -10

TRUE Chance

yes

0 85

TRUE 0.333333333

develop

80 70

33.3% Decision

medium reserves 48 MMb

-10 70

FALSE 0

no development

0 -10

TRUE 0.333333333

develop

5 -5

33.3% Decision

low reserves 20 MMb

-10 -5

FALSE 0

no development

0 -10

Decision

explore

85

FALSE 0

no

0 0

Figure 14.16 Decision tree example.