Page 381 - Hydrocarbon Exploration and Production Second Edition

P. 381

368 Summary of Risk Analysis Techniques in Exploration and Appraisal

30.0% 0.048

49 MMstb

Exploration cost 5 -20 -25

16.0% Risk weighted outcome

find oil

0 89

40.0% 0.064

156 MMstb

100 95

30.0% 0.048

406 MMstb

200 195

TRUE Risk weighted outcome

explore

-5 16.04

30.0% 0.030

104 Bcf

-20 -25

10.0% Risk weighted outcome

find gas

0 55

40.0% 0.040

325 Bcf

60 55

30.0% 0.030

811 Bcf

140 135

74.0% 0.740

find water

0 -5

EMV of decision

explore prospect A

16.04

FALSE 0

do nothing

0 0

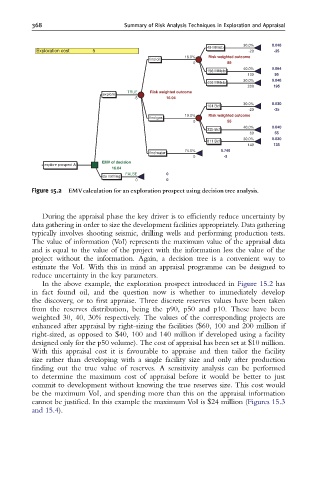

Figure 15.2 EMVcalculation for an exploration prospect using decision tree analysis.

During the appraisal phase the key driver is to efficiently reduce uncertainty by

data gathering in order to size the development facilities appropriately. Data gathering

typically involves shooting seismic, drilling wells and performing production tests.

The value of information (VoI) represents the maximum value of the appraisal data

and is equal to the value of the project with the information less the value of the

project without the information. Again, a decision tree is a convenient way to

estimate the VoI. With this in mind an appraisal programme can be designed to

reduce uncertainty in the key parameters.

In the above example, the exploration prospect introduced in Figure 15.2 has

in fact found oil, and the question now is whether to immediately develop

the discovery, or to first appraise. Three discrete reserves values have been taken

from the reserves distribution, being the p90, p50 and p10. These have been

weighted 30, 40, 30% respectively. The values of the corresponding projects are

enhanced after appraisal by right-sizing the facilities ($60, 100 and 200 million if

right-sized, as opposed to $40, 100 and 140 million if developed using a facility

designed only for the p50 volume). The cost of appraisal has been set at $10 million.

With this appraisal cost it is favourable to appraise and then tailor the facility

size rather than developing with a single facility size and only after production

finding out the true value of reserves. A sensitivity analysis can be performed

to determine the maximum cost of appraisal before it would be better to just

commit to development without knowing the true reserves size. This cost would

be the maximum VoI, and spending more than this on the appraisal information

cannot be justified. In this example the maximum VoI is $24 million (Figures 15.3

and 15.4).