Page 382 - Hydrocarbon Exploration and Production Second Edition

P. 382

Risk Analysis 369

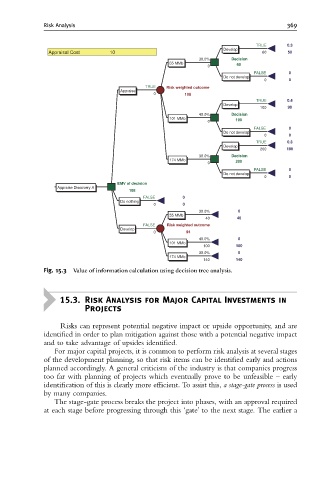

TRUE 0.3

Develop

Appraisal Cost 10 60 50

30.0% Decision

55 MMb 60

0

FALSE 0

Do not develop

0 0

TRUE Risk weighted outcome

Appraise

0 108

TRUE 0.4

Develop

100 90

40.0% Decision

101 MMb 100

0

FALSE 0

Do not develop

0 0

TRUE 0.3

Develop

200 190

30.0% Decision

174 MMb 200

0

FALSE 0

Do not develop

0 0

EMV of decision

Appraise Discovery A

108

FALSE 0

Do nothing

0 0

30.0% 0

55 MMb

40 40

FALSE Risk weighted outcome

Develop

0 94

40.0% 0

101 MMb

100 100

30.0% 0

174 MMb

140 140

Fig. 15.3 Value of information calculation using decision tree analysis.

15.3. Risk Analysis for Major Capital Investments in

Projects

Risks can represent potential negative impact or upside opportunity, and are

identified in order to plan mitigation against those with a potential negative impact

and to take advantage of upsides identified.

For major capital projects, it is common to perform risk analysis at several stages

of the development planning, so that risk items can be identified early and actions

planned accordingly. A general criticism of the industry is that companies progress

too far with planning of projects which eventually prove to be unfeasible – early

identification of this is clearly more efficient. To assist this, a stage-gate process is used

by many companies.

The stage-gate process breaks the project into phases, with an approval required

at each stage before progressing through this ‘gate’ to the next stage. The earlier a