Page 377 - Hydrocarbon Exploration and Production Second Edition

P. 377

364 Exploration Economics

Probability

of Success

(1 - pos)

(pos)

0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9

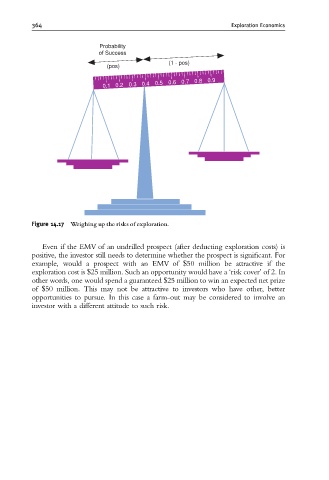

Figure 14.17 Weighing up the risks of exploration.

Even if the EMV of an undrilled prospect (after deducting exploration costs) is

positive, the investor still needs to determine whether the prospect is significant. For

example, would a prospect with an EMV of $50 million be attractive if the

exploration cost is $25 million. Such an opportunity would have a ‘risk cover’ of 2. In

other words, one would spend a guaranteed $25 million to win an expected net prize

of $50 million. This may not be attractive to investors who have other, better

opportunities to pursue. In this case a farm-out may be considered to involve an

investor with a different attitude to such risk.