Page 385 - Hydrocarbon Exploration and Production Second Edition

P. 385

372 Risk Analysis for Major Capital Investments in Projects

HIGH Ability of Host to Unappraised Costs poorly

segments of

handle field production

in timely manner the field understood

Manageability MED 2 drilling platforms Fiscal system

-is this an

not finalised

unnecessary cost

LOW CO levels will

2

impact the facilities

and pipeline specs

LOW MED HIGH

RISK = IMPACT * PROBABILITY

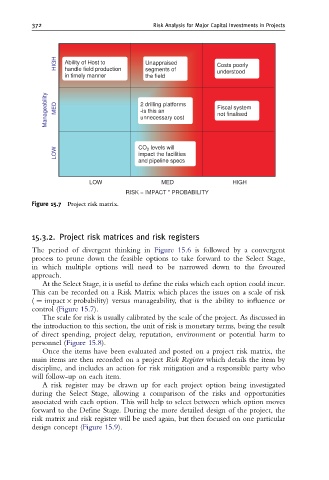

Figure 15.7 Project risk matrix.

15.3.2. Project risk matrices and risk registers

The period of divergent thinking in Figure 15.6 is followed by a convergent

process to prune down the feasible options to take forward to the Select Stage,

in which multiple options will need to be narrowed down to the favoured

approach.

At the Select Stage, it is useful to define the risks which each option could incur.

This can be recorded on a Risk Matrix which places the issues on a scale of risk

( ¼ impact probability) versus manageability, that is the ability to influence or

control (Figure 15.7).

The scale for risk is usually calibrated by the scale of the project. As discussed in

the introduction to this section, the unit of risk is monetary terms, being the result

of direct spending, project delay, reputation, environment or potential harm to

personnel (Figure 15.8).

Once the items have been evaluated and posted on a project risk matrix, the

main items are then recorded on a project Risk Register which details the item by

discipline, and includes an action for risk mitigation and a responsible party who

will follow-up on each item.

A risk register may be drawn up for each project option being investigated

during the Select Stage, allowing a comparison of the risks and opportunities

associated with each option. This will help to select between which option moves

forward to the Define Stage. During the more detailed design of the project, the

risk matrix and risk register will be used again, but then focused on one particular

design concept (Figure 15.9).