Page 388 - Hydrocarbon Exploration and Production Second Edition

P. 388

Risk Analysis 375

Spider Diagram

80

reserves

capex

60

fixopex

varopex

40 timing

price

20 Spiders Web

NPV (8%) -50 -40 -30 -20 -10 -20 0 10 20 30 40 50

0

-40

-60

-80

-100

-120

% Change in Parameter

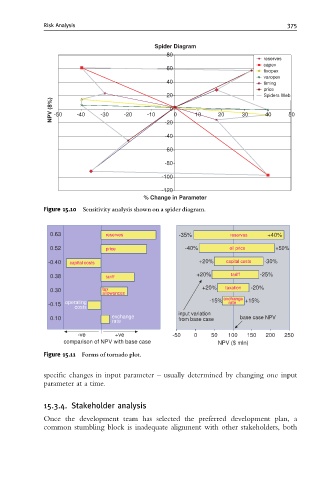

Figure 15.10 Sensitivity analysis shown on a spider diagram.

0.63 reserves -35% reserves +40%

0.52 price -40% oil price +50%

-0.40 capital costs +20% capital costs -30%

0.38 tariff +20% tariff -25%

0.30 tax +20% taxation -20%

allowances

rate

-0.15 operating -15% exchange +15%

costs

input variation

0.10 exchange from base case base case NPV

rate

-ve +ve -50 0 50 100 150 200 250

comparison of NPV with base case NPV ($ mln)

Figure 15.11 Forms of tornado plot.

specific changes in input parameter – usually determined by changing one input

parameter at a time.

15.3.4. Stakeholder analysis

Once the development team has selected the preferred development plan, a

common stumbling block is inadequate alignment with other stakeholders, both