Page 177 -

P. 177

Process 159

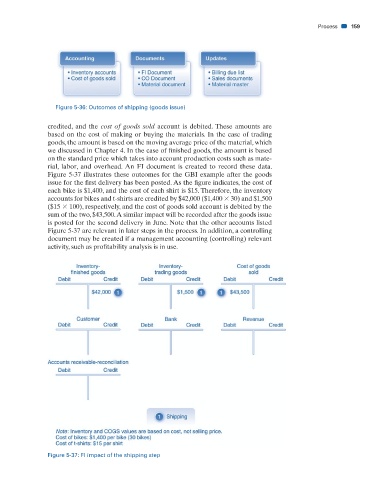

Figure 5-36: Outcomes of shipping (goods issue)

credited, and the cost of goods sold account is debited. These amounts are

based on the cost of making or buying the materials. In the case of trading

goods, the amount is based on the moving average price of the material, which

we discussed in Chapter 4. In the case of fi nished goods, the amount is based

on the standard price which takes into account production costs such as mate-

rial, labor, and overhead. An FI document is created to record these data.

Figure 5-37 illustrates these outcomes for the GBI example after the goods

issue for the fi rst delivery has been posted. As the fi gure indicates, the cost of

each bike is $1,400, and the cost of each shirt is $15. Therefore, the inventory

accounts for bikes and t-shirts are credited by $42,000 ($1,400 30) and $1,500

($15 100), respectively, and the cost of goods sold account is debited by the

sum of the two, $43,500. A similar impact will be recorded after the goods issue

is posted for the second delivery in June. Note that the other accounts listed

Figure 5-37 are relevant in later steps in the process. In addition, a controlling

document may be created if a management accounting (controlling) relevant

activity, such as profi tability analysis is in use.

Figure 5-37: FI impact of the shipping step

31/01/11 6:39 AM

CH005.indd 159 31/01/11 6:39 AM

CH005.indd 159