Page 184 -

P. 184

166 CHAPTER 5 The Fulfi llment Process

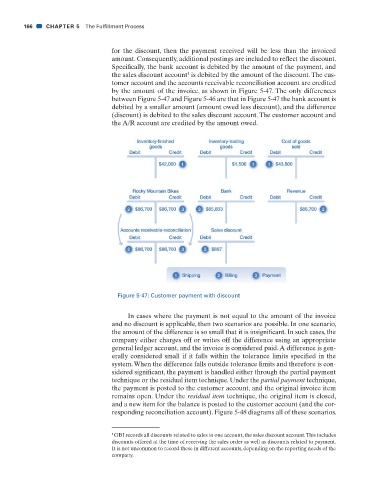

for the discount, then the payment received will be less than the invoiced

amount. Consequently, additional postings are included to refl ect the discount.

Specifi cally, the bank account is debited by the amount of the payment, and

the sales discount account is debited by the amount of the discount. The cus-

1

tomer account and the accounts receivable reconciliation account are credited

by the amount of the invoice, as shown in Figure 5-47. The only differences

between Figure 5-47 and Figure 5-46 are that in Figure 5-47 the bank account is

debited by a smaller amount (amount owed less discount), and the difference

(discount) is debited to the sales discount account. The customer account and

the A/R account are credited by the amount owed.

Figure 5-47: Customer payment with discount

In cases where the payment is not equal to the amount of the invoice

and no discount is applicable, then two scenarios are possible. In one scenario,

the amount of the difference is so small that it is insignifi cant. In such cases, the

company either charges off or writes off the difference using an appropriate

general ledger account, and the invoice is considered paid. A difference is gen-

erally considered small if it falls within the tolerance limits specifi ed in the

system. When the difference falls outside tolerance limits and therefore is con-

sidered signifi cant, the payment is handled either through the partial payment

technique or the residual item technique. Under the partial payment technique,

the payment is posted to the customer account, and the original invoice item

remains open. Under the residual item technique, the original item is closed,

and a new item for the balance is posted to the customer account (and the cor-

responding reconciliation account). Figure 5-48 diagrams all of these scenarios.

1 GBI records all discounts related to sales in one account, the sales discount account. This includes

discounts offered at the time of receiving the sales order as well as discounts related to payment.

It is not uncommon to record these in different accounts, depending on the reporting needs of the

company.

31/01/11 6:40 AM

CH005.indd 166 31/01/11 6:40 AM

CH005.indd 166