Page 186 -

P. 186

168 CHAPTER 5 The Fulfi llment Process

(3) when the post goods issue is performed during shipping. The process

can further be confi gured to consider a variety of criteria when making this

assessment, including the amount of current receivables from the customer

and the number and amount of open sales orders, scheduled deliveries, and

open invoices. In addition, third-party sources of credit data, such as Dunn &

Bradstreet, can also be utilized. The total credit exposure is calculated as the

sum of the value of open orders, scheduled deliveries, open invoices, and the

value of the current sales order. If the credit exposure exceeds the credit limit,

then the company must select one of three possible outcomes: (1) warn the

user and allow the process to continue, (2) display an error and do not allow

the process to continue, and (3) block delivery of the order. All three outcomes

are possible when the sales order or delivery document is being created or

changed. During the post goods issue, however, the only option is to block the

goods issue from being posted.

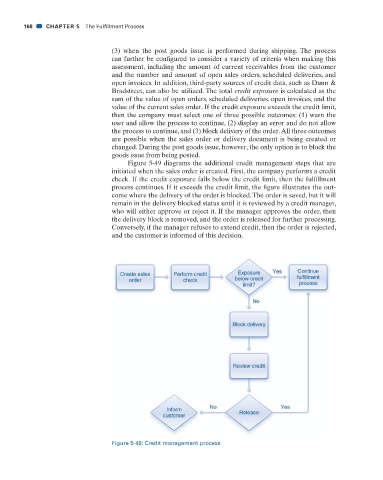

Figure 5-49 diagrams the additional credit management steps that are

initiated when the sales order is created. First, the company performs a credit

check. If the credit exposure falls below the credit limit, then the fulfi llment

process continues. If it exceeds the credit limit, the fi gure illustrates the out-

come where the delivery of the order is blocked. The order is saved, but it will

remain in the delivery blocked status until it is reviewed by a credit manager,

who will either approve or reject it. If the manager approves the order, then

the delivery block is removed, and the order is released for further processing.

Conversely, if the manager refuses to extend credit, then the order is rejected,

and the customer is informed of this decision.

Figure 5-49: Credit management process

31/01/11 6:40 AM

CH005.indd 168

CH005.indd 168 31/01/11 6:40 AM