Page 594 - Sensors and Control Systems in Manufacturing

P. 594

Economic and Social Inter ests in the Workplace

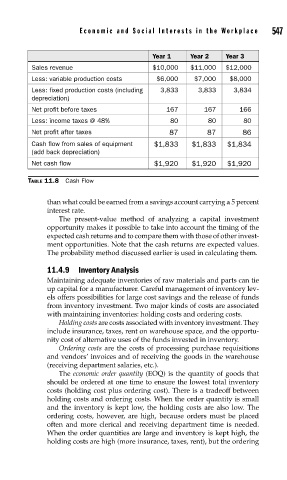

Year 1 Year 2 Year 3 547

Sales revenue $10,000 $11,000 $12,000

Less: variable production costs $6,000 $7,000 $8,000

Less: fixed production costs (including 3,833 3,833 3,834

depreciation)

Net profit before taxes 167 167 166

Less: income taxes @ 48% 80 80 80

Net profit after taxes 87 87 86

Cash flow from sales of equipment $1,833 $1,833 $1,834

(add back depreciation)

Net cash flow $1,920 $1,920 $1,920

TABLE 11.8 Cash Flow

than what could be earned from a savings account carrying a 5 percent

interest rate.

The present-value method of analyzing a capital investment

opportunity makes it possible to take into account the timing of the

expected cash returns and to compare them with those of other invest-

ment opportunities. Note that the cash returns are expected values.

The probability method discussed earlier is used in calculating them.

11.4.9 Inventory Analysis

Maintaining adequate inventories of raw materials and parts can tie

up capital for a manufacturer. Careful management of inventory lev-

els offers possibilities for large cost savings and the release of funds

from inventory investment. Two major kinds of costs are associated

with maintaining inventories: holding costs and ordering costs.

Holding costs are costs associated with inventory investment. They

include insurance, taxes, rent on warehouse space, and the opportu-

nity cost of alternative uses of the funds invested in inventory.

Ordering costs are the costs of processing purchase requisitions

and vendors’ invoices and of receiving the goods in the warehouse

(receiving department salaries, etc.).

The economic order quantity (EOQ) is the quantity of goods that

should be ordered at one time to ensure the lowest total inventory

costs (holding cost plus ordering cost). There is a tradeoff between

holding costs and ordering costs. When the order quantity is small

and the inventory is kept low, the holding costs are also low. The

ordering costs, however, are high, because orders must be placed

often and more clerical and receiving department time is needed.

When the order quantities are large and inventory is kept high, the

holding costs are high (more insurance, taxes, rent), but the ordering