Page 205 - Solid Waste Analysis and Minimization a Systems Approach

P. 205

CASE STUDY—MAJOR WASTE STREAMS 183

there may be opportunity for the manufacturer to sell the metal banding to a metal

recycler rather than paying to have it hauled away. The company would need to deter-

mine the material composition of the banding in order to investigate metal recyclers.

8.10.12 NON-MAJOR RECYCLABLE WASTE STREAMS

The following is a list of recycling opportunities for waste streams that are not one of

the 11 major waste streams.

Used beverage containers (pop cans) The company generates about 4645 lb

of aluminum pop cans per year. Aluminum pop cans are easily recyclable. Another

benefit of recycling pop cans is that proceeds from recycling could be donated to a

public relations project. Current market value for aluminum is $0.60 per pound, accord-

ing to the Global Recycling Network. This would create annual revenue of about

$2787 from selling the cans.

In order to ease the maintenance and storage of pop cans at the facility, a can crusher

could be installed. The waste assessment team performed an economic analysis to

determine if this was cost justifiable. Table 8.16 illustrates the result.

Unfortunately, purchasing a can crusher is not currently cost justifiable for the com-

pany because the annual revenue after depreciation and taxes is negative.

An aluminum can recycling program can still be instituted at the company by set-

ting up areas to collect cans and contracting with a local recycler. Some aluminum

recyclers are shown in Table 8.17 along with their terms.

Film plastic (low density polyethylene) The thick plastic wrap used for ship-

ping is potentially recyclable. The company currently disposes approximately 9.4 tons

of plastic wrap per year. Previously, attempts had been made to recycle the plastic

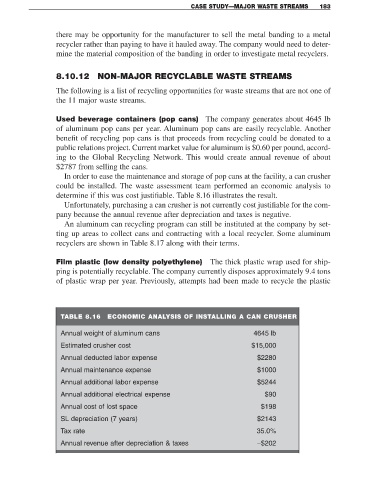

TABLE 8.16 ECONOMIC ANALYSIS OF INSTALLING A CAN CRUSHER

Annual weight of aluminum cans 4645 lb

Estimated crusher cost $15,000

Annual deducted labor expense $2280

Annual maintenance expense $1000

Annual additional labor expense $5244

Annual additional electrical expense $90

Annual cost of lost space $198

SL depreciation (7 years) $2143

Tax rate 35.0%

Annual revenue after depreciation & taxes −$202