Page 307 -

P. 307

CHAPTER 8 • IMPLEMENTING STRATEGIES: MARKETING, FINANCE/ACCOUNTING, R&D, AND MIS ISSUES 273

the United States must issue an annual cash-flow statement in addition to the usual finan-

cial reports. The statement includes all receipts and disbursements of cash in operations,

investments, and financing. It supplements the Statement on Changes in Financial Position

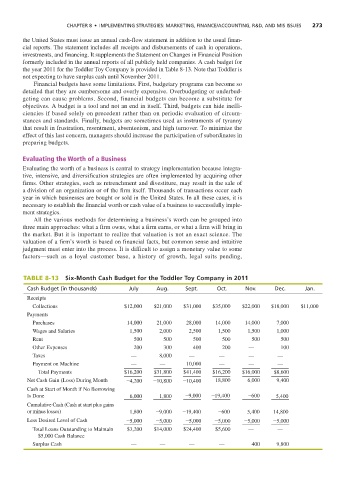

formerly included in the annual reports of all publicly held companies. A cash budget for

the year 2011 for the Toddler Toy Company is provided in Table 8-13. Note that Toddler is

not expecting to have surplus cash until November 2011.

Financial budgets have some limitations. First, budgetary programs can become so

detailed that they are cumbersome and overly expensive. Overbudgeting or underbud-

geting can cause problems. Second, financial budgets can become a substitute for

objectives. A budget is a tool and not an end in itself. Third, budgets can hide ineffi-

ciencies if based solely on precedent rather than on periodic evaluation of circum-

stances and standards. Finally, budgets are sometimes used as instruments of tyranny

that result in frustration, resentment, absenteeism, and high turnover. To minimize the

effect of this last concern, managers should increase the participation of subordinates in

preparing budgets.

Evaluating the Worth of a Business

Evaluating the worth of a business is central to strategy implementation because integra-

tive, intensive, and diversification strategies are often implemented by acquiring other

firms. Other strategies, such as retrenchment and divestiture, may result in the sale of

a division of an organization or of the firm itself. Thousands of transactions occur each

year in which businesses are bought or sold in the United States. In all these cases, it is

necessary to establish the financial worth or cash value of a business to successfully imple-

ment strategies.

All the various methods for determining a business’s worth can be grouped into

three main approaches: what a firm owns, what a firm earns, or what a firm will bring in

the market. But it is important to realize that valuation is not an exact science. The

valuation of a firm’s worth is based on financial facts, but common sense and intuitive

judgment must enter into the process. It is difficult to assign a monetary value to some

factors—such as a loyal customer base, a history of growth, legal suits pending,

TABLE 8-13 Six-Month Cash Budget for the Toddler Toy Company in 2011

Cash Budget (in thousands) July Aug. Sept. Oct. Nov. Dec. Jan.

Receipts

Collections $12,000 $21,000 $31,000 $35,000 $22,000 $18,000 $11,000

Payments

Purchases 14,000 21,000 28,000 14,000 14,000 7,000

Wages and Salaries 1,500 2,000 2,500 1,500 1,500 1,000

Rent 500 500 500 500 500 500

Other Expenses 200 300 400 200 — 100

Taxes — 8,000 — — — —

Payment on Machine — — 10,000 — — —

Total Payments $16,200 $31,800 $41,400 $16,200 $16,000 $8,600

Net Cash Gain (Loss) During Month -4,200 -10,800 -10,400 18,800 6,000 9,400

Cash at Start of Month if No Borrowing

Is Done 6,000 1,800 -9,000 -19,400 -600 5,400

Cumulative Cash (Cash at start plus gains

or minus losses) 1,800 -9,000 -19,400 -600 5,400 14,800

Less Desired Level of Cash -5,000 -5,000 -5,000 -5,000 -5,000 -5,000

Total Loans Outstanding to Maintain $3,200 $14,000 $24,400 $5,600 — —

$5,000 Cash Balance

Surplus Cash — — — — 400 9,800