Page 306 -

P. 306

272 PART 3 • STRATEGY IMPLEMENTATION

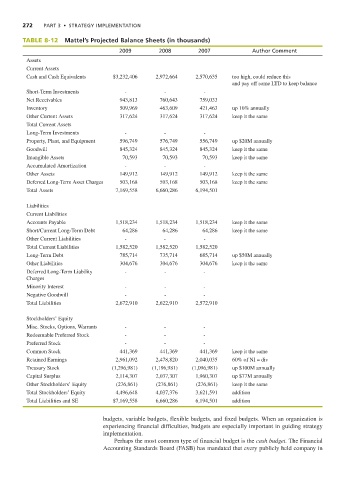

TABLE 8-12 Mattel’s Projected Balance Sheets (in thousands)

2009 2008 2007 Author Comment

Assets

Current Assets

Cash and Cash Equivalents $3,232,406 2,972,664 2,570,635 too high, could reduce this

and pay off some LTD to keep balance

Short-Term Investments - - -

Net Receivables 943,813 760,643 759,033

Inventory 509,969 463,609 421,463 up 10% annually

Other Current Assets 317,624 317,624 317,624 keep it the same

Total Current Assets

Long-Term Investments - - -

Property, Plant, and Equipment 596,749 576,749 556,749 up $20M annually

Goodwill 845,324 845,324 845,324 keep it the same

Intangible Assets 70,593 70,593 70,593 keep it the same

Accumulated Amortization - - -

Other Assets 149,912 149,912 149,912 keep it the same

Deferred Long-Term Asset Charges 503,168 503,168 503,168 keep it the same

Total Assets 7,169,558 6,660,286 6,194,501

Liabilities

Current Liabilities

Accounts Payable 1,518,234 1,518,234 1,518,234 keep it the same

Short/Current Long-Term Debt 64,286 64,286 64,286 keep it the same

Other Current Liabilities - - -

Total Current Liabilities 1,582,520 1,582,520 1,582,520

Long-Term Debt 785,714 735,714 685,714 up $50M annually

Other Liabilities 304,676 304,676 304,676 keep it the same

Deferred Long-Term Liability - - -

Charges

Minority Interest - - -

Negative Goodwill - - -

Total Liabilities 2,672,910 2,622,910 2,572,910

Stockholders’ Equity

Misc. Stocks, Options, Warrants - - -

Redeemable Preferred Stock - - -

Preferred Stock - - -

Common Stock 441,369 441,369 441,369 keep it the same

Retained Earnings 2,961,092 2,478,820 2,040,035 60% of NI = div

Treasury Stock (1,296,981) (1,196,981) (1,096,981) up $100M annually

Capital Surplus 2,114,307 2,037,307 1,960,307 up $77M annually

Other Stockholders’ Equity (276,861) (276,861) (276,861) keep it the same

Total Stockholders’ Equity 4,496,648 4,037,376 3,621,591 addition

Total Liabilities and SE $7,169,558 6,660,286 6,194,501 addition

budgets, variable budgets, flexible budgets, and fixed budgets. When an organization is

experiencing financial difficulties, budgets are especially important in guiding strategy

implementation.

Perhaps the most common type of financial budget is the cash budget. The Financial

Accounting Standards Board (FASB) has mandated that every publicly held company in