Page 301 -

P. 301

CHAPTER 8 • IMPLEMENTING STRATEGIES: MARKETING, FINANCE/ACCOUNTING, R&D, AND MIS ISSUES 267

Primarily as a result of the Enron collapse and accounting scandal and the ensuing

Sarbanes-Oxley Act, companies today are being much more diligent in preparing pro-

jected financial statements to “reasonably rather than too optimistically” project future

expenses and earnings. There is much more care not to mislead shareholders and other

constituencies. 13

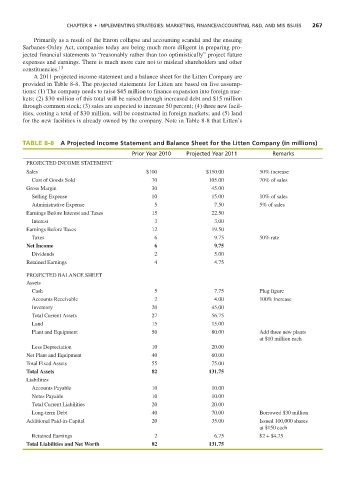

A 2011 projected income statement and a balance sheet for the Litten Company are

provided in Table 8-8. The projected statements for Litten are based on five assump-

tions: (1) The company needs to raise $45 million to finance expansion into foreign mar-

kets; (2) $30 million of this total will be raised through increased debt and $15 million

through common stock; (3) sales are expected to increase 50 percent; (4) three new facil-

ities, costing a total of $30 million, will be constructed in foreign markets; and (5) land

for the new facilities is already owned by the company. Note in Table 8-8 that Litten’s

TABLE 8-8 A Projected Income Statement and Balance Sheet for the Litten Company (in millions)

Prior Year 2010 Projected Year 2011 Remarks

PROJECTED INCOME STATEMENT

Sales $100 $150.00 50% increase

Cost of Goods Sold 70 105.00 70% of sales

Gross Margin 30 45.00

Selling Expense 10 15.00 10% of sales

Administrative Expense 5 I7.50 5% of sales

Earnings Before Interest and Taxes 15 22.50

Interest 3 3.00

Earnings Before Taxes 12 19.50

Taxes 6 9.75 50% rate

Net Income 6 9.75

Dividends 2 5.00

Retained Earnings 4 4.75

PROJECTED BALANCE SHEET

Assets

Cash 5 7.75 Plug figure

Accounts Receivable 2 4.00 100% increase

Inventory 20 45.00

Total Current Assets 27 56.75

Land 15 15.00

Plant and Equipment 50 80.00 Add three new plants

at $10 million each

Less Depreciation 10 20.00

Net Plant and Equipment 40 60.00

Total Fixed Assets 55 75.00

Total Assets 82 131.75

Liabilities

Accounts Payable 10 10.00

Notes Payable 10 10.00

Total Current Liabilities 20 20.00

Long-term Debt 40 70.00 Borrowed $30 million

Additional Paid-in-Capital 20 35.00 Issued 100,000 shares

at $150 each

Retained Earnings 2 6.75 $2 + $4.75

Total Liabilities and Net Worth 82 131.75