Page 299 -

P. 299

CHAPTER 8 • IMPLEMENTING STRATEGIES: MARKETING, FINANCE/ACCOUNTING, R&D, AND MIS ISSUES 265

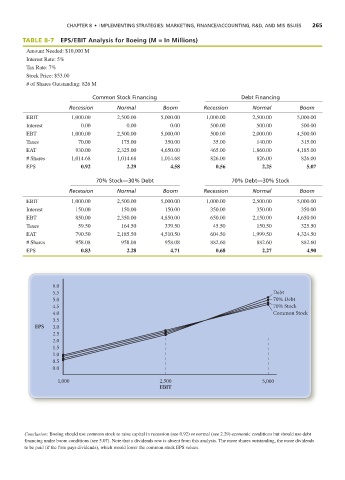

TABLE 8-7 EPS/EBIT Analysis for Boeing (M = In Millions)

Amount Needed: $10,000 M

Interest Rate: 5%

Tax Rate: 7%

Stock Price: $53.00

# of Shares Outstanding: 826 M

Common Stock Financing Debt Financing

Recession Normal Boom Recession Normal Boom

EBIT 1,000.00 2,500.00 5,000.00 1,000.00 2,500.00 5,000.00

Interest 0.00 0.00 0.00 500.00 500.00 500.00

EBT 1,000.00 2,500.00 5,000.00 500.00 2,000.00 4,500.00

Taxes 70.00 175.00 350.00 35.00 140.00 315.00

EAT 930.00 2,325.00 4,650.00 465.00 1,860.00 4,185.00

# Shares 1,014.68 1,014.68 1,014.68 826.00 826.00 826.00

EPS 0.92 2.29 4.58 0.56 2.25 5.07

70% Stock—30% Debt 70% Debt—30% Stock

Recession Normal Boom Recession Normal Boom

EBIT 1,000.00 2,500.00 5,000.00 1,000.00 2,500.00 5,000.00

Interest 150.00 150.00 150.00 350.00 350.00 350.00

EBT 850.00 2,350.00 4,850.00 650.00 2,150.00 4,650.00

Taxes 59.50 164.50 339.50 45.50 150.50 325.50

EAT 790.50 2,185.50 4,510.50 604.50 1,999.50 4,324.50

# Shares 958.08 958.08 958.08 882.60 882.60 882.60

EPS 0.83 2.28 4.71 0.68 2.27 4.90

6.0

5.5 Debt

5.0 70% Debt

4.5 70% Stock

4.0 Common Stock

3.5

EPS 3.0

2.5

2.0

1.5

1.0

0.5

0.0

1,000 2,500 5,000

EBIT

Conclusion: Boeing should use common stock to raise capital in recession (see 0.92) or normal (see 2.29) economic conditions but should use debt

financing under boom conditions (see 5.07). Note that a dividends row is absent from this analysis. The more shares outstanding, the more dividends

to be paid (if the firm pays dividends), which would lower the common stock EPS values.