Page 298 -

P. 298

264 PART 3 • STRATEGY IMPLEMENTATION

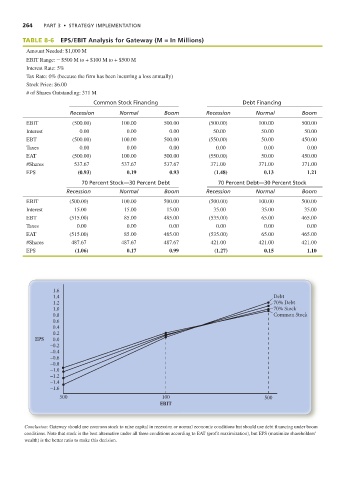

TABLE 8-6 EPS/EBIT Analysis for Gateway (M = In Millions)

Amount Needed: $1,000 M

EBIT Range: - $500 M to + $100 M to + $500 M

Interest Rate: 5%

Tax Rate: 0% (because the firm has been incurring a loss annually)

Stock Price: $6.00

# of Shares Outstanding: 371 M

Common Stock Financing Debt Financing

Recession Normal Boom Recession Normal Boom

EBIT (500.00) 100.00 500.00 (500.00) 100.00 500.00

Interest 0.00 0.00 0.00 50.00 50.00 50.00

EBT (500.00) 100.00 500.00 (550.00) 50.00 450.00

Taxes 0.00 0.00 0.00 0.00 0.00 0.00

EAT (500.00) 100.00 500.00 (550.00) 50.00 450.00

#Shares 537.67 537.67 537.67 371.00 371.00 371.00

EPS (0.93) 0.19 0.93 (1.48) 0.13 1.21

70 Percent Stock—30 Percent Debt 70 Percent Debt—30 Percent Stock

Recession Normal Boom Recession Normal Boom

EBIT (500.00) 100.00 500.00 (500.00) 100.00 500.00

Interest 15.00 15.00 15.00 35.00 35.00 35.00

EBT (515.00) 85.00 485.00 (535.00) 65.00 465.00

Taxes 0.00 0.00 0.00 0.00 0.00 0.00

EAT (515.00) 85.00 485.00 (535.00) 65.00 465.00

#Shares 487.67 487.67 487.67 421.00 421.00 421.00

EPS (1.06) 0.17 0.99 (1.27) 0.15 1.10

1.6

1.4 Debt

1.2 70% Debt

1.0 70% Stock

0.8 Common Stock

0.6

0.4

0.2

EPS 0.0

–0.2

–0.4

–0.6

–0.8

–1.0

–1.2

–1.4

–1.6

500 100 500

EBIT

Conclusion: Gateway should use common stock to raise capital in recession or normal economic conditions but should use debt financing under boom

conditions. Note that stock is the best alternative under all three conditions according to EAT (profit maximization), but EPS (maximize shareholders’

wealth) is the better ratio to make this decision.