Page 303 -

P. 303

CHAPTER 8 • IMPLEMENTING STRATEGIES: MARKETING, FINANCE/ACCOUNTING, R&D, AND MIS ISSUES 269

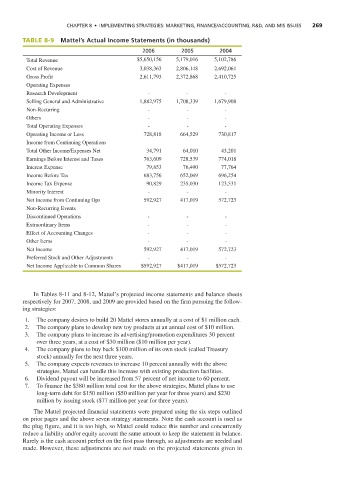

TABLE 8-9 Mattel’s Actual Income Statements (in thousands)

2006 2005 2004

Total Revenue $5,650,156 5,179,016 5,102,786

Cost of Revenue 3,038,363 2,806,148 2,692,061

Gross Profit 2,611,793 2,372,868 2,410,725

Operating Expenses

Research Development - - -

Selling General and Administrative 1,882,975 1,708,339 1,679,908

Non-Recurring - - -

Others - - -

Total Operating Expenses - - -

Operating Income or Loss 728,818 664,529 730,817

Income from Continuing Operations

Total Other Income/Expenses Net 34,791 64,010 43,201

Earnings Before Interest and Taxes 763,609 728,539 774,018

Interest Expense 79,853 76,490 77,764

Income Before Tax 683,756 652,049 696,254

Income Tax Expense 90,829 235,030 123,531

Minority Interest - - -

Net Income from Continuing Ops 592,927 417,019 572,723

Non-Recurring Events

Discontinued Operations - - -

Extraordinary Items - - -

Effect of Accounting Changes - - -

Other Items - - -

Net Income 592,927 417,019 572,723

Preferred Stock and Other Adjustments - - -

Net Income Applicable to Common Shares $592,927 $417,019 $572,723

In Tables 8-11 and 8-12, Mattel’s projected income statements and balance sheets

respectively for 2007, 2008, and 2009 are provided based on the firm pursuing the follow-

ing strategies:

1. The company desires to build 20 Mattel stores annually at a cost of $1 million each.

2. The company plans to develop new toy products at an annual cost of $10 million.

3. The company plans to increase its advertising/promotion expenditures 30 percent

over three years, at a cost of $30 million ($10 million per year).

4. The company plans to buy back $100 million of its own stock (called Treasury

stock) annually for the next three years.

5. The company expects revenues to increase 10 percent annually with the above

strategies. Mattel can handle this increase with existing production facilities.

6. Dividend payout will be increased from 57 percent of net income to 60 percent.

7. To finance the $380 million total cost for the above strategies, Mattel plans to use

long-term debt for $150 million ($50 million per year for three years) and $230

million by issuing stock ($77 million per year for three years).

The Mattel projected financial statements were prepared using the six steps outlined

on prior pages and the above seven strategy statements. Note the cash account is used as

the plug figure, and it is too high, so Mattel could reduce this number and concurrently

reduce a liability and/or equity account the same amount to keep the statement in balance.

Rarely is the cash account perfect on the first pass through, so adjustments are needed and

made. However, these adjustments are not made on the projected statements given in