Page 304 -

P. 304

270 PART 3 • STRATEGY IMPLEMENTATION

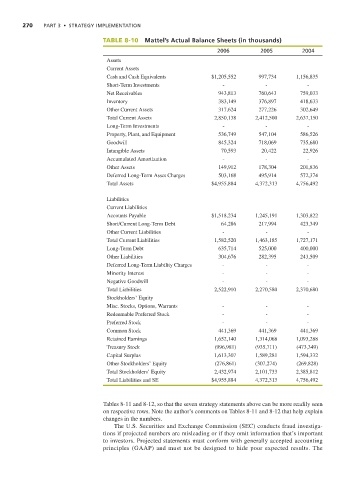

TABLE 8-10 Mattel’s Actual Balance Sheets (in thousands)

2006 2005 2004

Assets

Current Assets

Cash and Cash Equivalents $1,205,552 997,734 1,156,835

Short-Term Investments - - -

Net Receivables 943,813 760,643 759,033

Inventory 383,149 376,897 418,633

Other Current Assets 317,624 277,226 302,649

Total Current Assets 2,850,138 2,412,500 2,637,150

Long-Term Investments - - -

Property, Plant, and Equipment 536,749 547,104 586,526

Goodwill 845,324 718,069 735,680

Intangible Assets 70,593 20,422 22,926

Accumulated Amortization - - -

Other Assets 149,912 178,304 201,836

Deferred Long-Term Asset Charges 503,168 495,914 572,374

Total Assets $4,955,884 4,372,313 4,756,492

Liabilities

Current Liabilities

Accounts Payable $1,518,234 1,245,191 1,303,822

Short/Current Long-Term Debt 64,286 217,994 423,349

Other Current Liabilities - - -

Total Current Liabilities 1,582,520 1,463,185 1,727,171

Long-Term Debt 635,714 525,000 400,000

Other Liabilities 304,676 282,395 243,509

Deferred Long-Term Liability Charges - - -

Minority Interest - - -

Negative Goodwill - - -

Total Liabilities 2,522,910 2,270,580 2,370,680

Stockholders’ Equity

Misc. Stocks, Options, Warrants - - -

Redeemable Preferred Stock - - -

Preferred Stock - - -

Common Stock 441,369 441,369 441,369

Retained Earnings 1,652,140 1,314,068 1,093,288

Treasury Stock (996,981) (935,711) (473,349)

Capital Surplus 1,613,307 1,589,281 1,594,332

Other Stockholders’ Equity (276,861) (307,274) (269,828)

Total Stockholders’ Equity 2,432,974 2,101,733 2,385,812

Total Liabilities and SE $4,955,884 4,372,313 4,756,492

Tables 8-11 and 8-12, so that the seven strategy statements above can be more readily seen

on respective rows. Note the author’s comments on Tables 8-11 and 8-12 that help explain

changes in the numbers.

The U.S. Securities and Exchange Commission (SEC) conducts fraud investiga-

tions if projected numbers are misleading or if they omit information that’s important

to investors. Projected statements must conform with generally accepted accounting

principles (GAAP) and must not be designed to hide poor expected results. The