Page 410 -

P. 410

6 MERNOUSH BANTON

Entertainment Services, A&E Television Networks, E! Entertainment, ESPN, History

Channel, The Biography Channel, Hyperion Books, and Disney Mobile.

The increase in revenue in this segment was primarily due to growth from cable and

satellite operators, which are generally derived from fees charged on a per subscriber basis,

contractual rate increases, and higher adverting rates at ESPN. The increase in broadcasting

revenue was due to growth at the ABC Television Network and increased sales of Touchstone

Television series as well as an increase in prime-time advertising revenues. Increase in sales

from Touchstone Television series was as a result of higher international syndication and DVD

sales of hit dramas such as Lost, Grey’s Anatomy, and Desperate Housewives, as well as higher

third-party license fees led by Scrubs, which completed its fifth season of network television.

Two major TV networks of Disney (ABC and ESPN) recently struck a deal with

cable operator Cox Communication whereby these companies now offer hit shows and

football games on demand. Although advertising in the network is a source of additional

revenue for the broadcasters, it requires selectivity for charging for each episode. Video-

on-demand is a major industry and is expected to grow to $3.9 billion by 2010.

Disney recently unveiled Disney Xtreme Digital, a networking site aimed at children

younger than 14 years of age. This service will be competing against MySpace (owned by

News Corporation). Disney has reported an increase in fiscal 2009 second-quarter net

income mostly as a result of strong gains at cable network ESPN. Higher advertising rev-

enues are reflected due to NASCAR programming at ESPN, an increase at ABC Family

primarily due to higher rates, higher other revenues by DVD sales primarily from High

School Musical, and a favorable settlement of a claim with an international distributor.

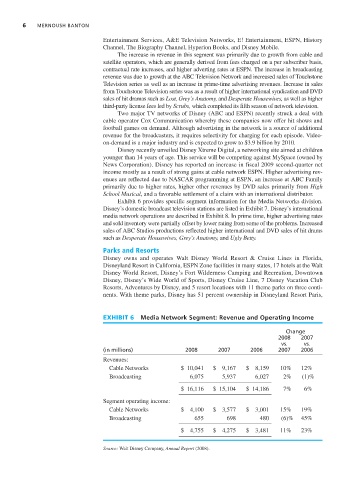

Exhibit 6 provides specific segment information for the Media Networks division.

Disney’s domestic broadcast television stations are listed in Exhibit 7. Disney’s international

media network operations are described in Exhibit 8. In prime time, higher advertising rates

and sold inventory were partially offset by lower rating from some of the problems. Increased

sales of ABC Studios productions reflected higher international and DVD sales of hit drams

such as Desperate Housewives, Grey’s Anatomy, and Ugly Betty.

Parks and Resorts

Disney owns and operates Walt Disney World Resort & Cruise Lines in Florida,

Disneyland Resort in California, ESPN Zone facilities in many states, 17 hotels at the Walt

Disney World Resort, Disney’s Fort Wilderness Camping and Recreation, Downtown

Disney, Disney’s Wide World of Sports, Disney Cruise Line, 7 Disney Vacation Club

Resorts, Adventures by Disney, and 5 resort locations with 11 theme parks on three conti-

nents. With theme parks, Disney has 51 percent ownership in Disneyland Resort Paris,

EXHIBIT 6 Media Network Segment: Revenue and Operating Income

Change

2008 2007

vs. vs.

(in millions) 2008 2007 2006 2007 2006

Revenues:

Cable Networks $ 10,041 $ 9,167 $ 8,159 10% 12%

Broadcasting 6,075 5,937 6,027 2% (1)%

$ 16,116 $ 15,104 $ 14,186 7% 6%

Segment operating income:

Cable Networks $ 4,100 $ 3,577 $ 3,001 15% 19%

Broadcasting 655 698 480 (6)% 45%

$ 4,755 $ 4,275 $ 3,481 11% 23%

Source: Walt Disney Company, Annual Report (2008).