Page 464 -

P. 464

60 AMIT J. SHAH AND MICHAEL L. MONAHANAT

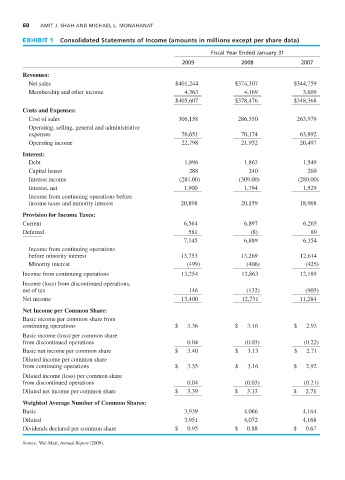

EXHIBIT 1 Consolidated Statements of Income (amounts in millions except per share data)

Fiscal Year Ended January 31

2009 2008 2007

Revenues:

Net sales $401,244 $374,307 $344,759

Membership and other income 4,363 4,169 3,609

$405,607 $378,476 $348,368

Costs and Expenses:

Cost of sales 306,158 286,350 263,979

Operating, selling, general and administrative

expenses 76,651 70,174 63,892

Operating income 22,798 21,952 20,497

Interest:

Debt 1,896 1,863 1,549

Capital leases 288 240 260

Interest income (284.00) (309.00) (280.00)

Interest, net 1,900 1,794 1,529

Income from continuing operations before

income taxes and minority interest 20,898 20,159 18,968

Provision for Income Taxes:

Current 6,564 6,897 6,265

Deferred 581 (8) 89

7,145 6,889 6,354

Income from continuing operations

before minority interest 13,753 13,269 12,614

Minority interest (499) (406) (425)

Income from continuing operations 13,254 12,863 12,189

Income (loss) from discontinued operations,

net of tax 146 (132) (905)

Net income 13,400 12,731 11,284

Net Income per Common Share:

Basic income per common share from

continuing operations $ 3.36 $ 3.16 $ 2.93

Basic income (loss) per common share

from discontinued operations 0.04 (0.03) (0.22)

Basic net income per common share $ 3.40 $ 3.13 $ 2.71

Diluted income per common share

from continuing operations $ 3.35 $ 3.16 $ 2.92

Diluted income (loss) per common share

from discontinued operations 0.04 (0.03) (0.21)

Diluted net income per common share $ 3.39 $ 3.13 $ 2.71

Weighted Average Number of Common Shares:

Basic 3,939 4,066 4,164

Diluted 3,951 4,072 4,168

Dividends declared per common share $ 0.95 $ 0.88 $ 0.67

Source: Wal-Mart, Annual Report (2009).