Page 465 -

P. 465

CASE 6 • WAL-MART STORES, INC. — 2009 61

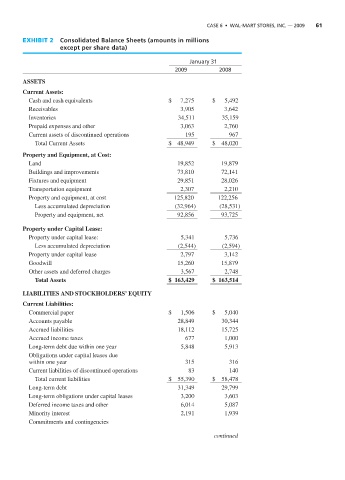

EXHIBIT 2 Consolidated Balance Sheets (amounts in millions

except per share data)

January 31

2009 2008

ASSETS

Current Assets:

Cash and cash equivalents $ 7,275 $ 5,492

Receivables 3,905 3,642

Inventories 34,511 35,159

Prepaid expenses and other 3,063 2,760

Current assets of discontinued operations 195 967

Total Current Assets $ 48,949 $ 48,020

Property and Equipment, at Cost:

Land 19,852 19,879

Buildings and improvements 73,810 72,141

Fixtures and equipment 29,851 28,026

Transportation equipment 2,307 2,210

Property and equipment, at cost 125,820 122,256

Less accumulated depreciation (32,964) (28,531)

Property and equipment, net 92,856 93,725

Property under Capital Lease:

Property under capital lease: 5,341 5,736

Less accumulated depreciation (2,544) (2,594)

Property under capital lease 2,797 3,142

Goodwill 15,260 15,879

Other assets and deferred charges 3,567 2,748

Total Assets $ 163,429 $ 163,514

LIABILITIES AND STOCKHOLDERS’ EQUITY

Current Liabilities:

Commercial paper $ 1,506 $ 5,040

Accounts payable 28,849 30,344

Accrued liabilities 18,112 15,725

Accrued income taxes 677 1,000

Long-term debt due within one year 5,848 5,913

Obligations under capital leases due

within one year 315 316

Current liabilities of discontinued operations 83 140

Total current liabilities $ 55,390 $ 58,478

Long-term debt 31,349 29,799

Long-term obligations under capital leases 3,200 3,603

Deferred income taxes and other 6,014 5,087

Minority interest 2,191 1,939

Commitments and contingencies

continued