Page 498 -

P. 498

94 HAMID KAZEROONY

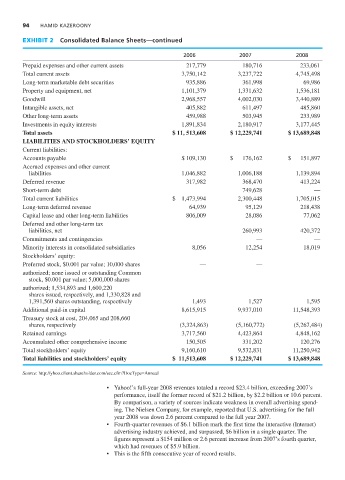

EXHIBIT 2 Consolidated Balance Sheets—continued

2006 2007 2008

Prepaid expenses and other current assets 217,779 180,716 233,061

Total current assets 3,750,142 3,237,722 4,745,498

Long-term marketable debt securities 935,886 361,998 69,986

Property and equipment, net 1,101,379 1,331,632 1,536,181

Goodwill 2,968,557 4,002,030 3,440,889

Intangible assets, net 405,882 611,497 485,860

Other long-term assets 459,988 503,945 233,989

Investments in equity interests 1,891,834 2,180,917 3,177,445

Total assets $ 11, 513,608 $ 12,229,741 $ 13,689,848

LIABILITIES AND STOCKHOLDERS’ EQUITY

Current liabilities:

Accounts payable $ 109,130 $ 176,162 $ 151,897

Accrued expenses and other current

liabilities 1,046,882 1,006,188 1,139,894

Deferred revenue 317,982 368,470 413,224

Short-term debt 749,628 —

Total current liabilities $ 1,473,994 2,300,448 1,705,015

Long-term deferred revenue 64,939 95,129 218,438

Capital lease and other long-term liabilities 806,009 28,086 77,062

Deferred and other long-term tax

liabilities, net 260,993 420,372

Commitments and contingencies — —

Minority interests in consolidated subsidiaries 8,056 12,254 18,019

Stockholders’ equity:

Preferred stock, $0.001 par value; 10,000 shares — —

authorized; none issued or outstanding Common

stock, $0.001 par value; 5,000,000 shares

authorized; 1,534,893 and 1,600,220

shares issued, respectively, and 1,330,828 and

1,391,560 shares outstanding, respectively 1,493 1,527 1,595

Additional paid-in capital 8,615,915 9,937,010 11,548,393

Treasury stock at cost, 204,065 and 208,660

shares, respectively (3,324,863) (5,160,772) (5,267,484)

Retained earnings 3,717,560 4,423,864 4,848,162

Accumulated other comprehensive income 150,505 331,202 120,276

Total stockholders’ equity 9,160,610 9,532,831 11,250,942

Total liabilities and stockholders’ equity $ 11,513,608 $ 12,229,741 $ 13,689,848

Source: http://yhoo.client.shareholder.com/sec.cfm?DocType=Annual

• Yahoo!’s full-year 2008 revenues totaled a record $23.4 billion, exceeding 2007’s

performance, itself the former record of $21.2 billion, by $2.2 billion or 10.6 percent.

By comparison, a variety of sources indicate weakness in overall advertising spend-

ing. The Nielsen Company, for example, reported that U.S. advertising for the full

year 2008 was down 2.6 percent compared to the full year 2007.

• Fourth-quarter revenues of $6.1 billion mark the first time the interactive (Internet)

advertising industry achieved, and surpassed, $6 billion in a single quarter. The

figures represent a $154 million or 2.6 percent increase from 2007’s fourth quarter,

which had revenues of $5.9 billion.

• This is the fifth consecutive year of record results.