Page 501 -

P. 501

CASE 9 • YAHOO! INC. — 2009 97

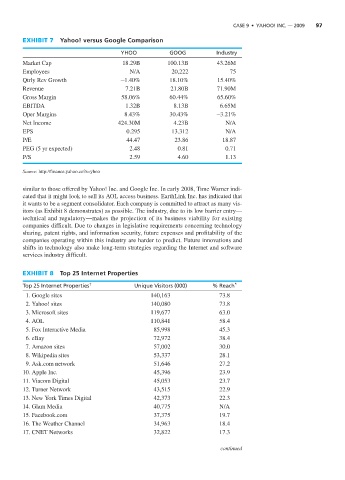

EXHIBIT 7 Yahoo! versus Google Comparison

YHOO GOOG Industry

Market Cap 18.29B 100.13B 43.26M

Employees N/A 20,222 75

Qtrly Rev Growth -1.40% 18.10% 15.40%

Revenue 7.21B 21.80B 71.90M

Gross Margin 58.06% 60.44% 65.60%

EBITDA 1.32B 8.13B 6.65M

Oper Margins 8.43% 30.43% -3.21%

Net Income 424.30M 4.23B N/A

EPS 0.295 13.312 N/A

P/E 44.47 23.86 18.87

PEG (5 yr expected) 2.48 0.81 0.71

P/S 2.59 4.60 1.13

Source: http://finance.yahoo.co?s=yhoo

similar to those offered by Yahoo! Inc. and Google Inc. In early 2008, Time Warner indi-

cated that it might look to sell its AOL access business. EarthLink Inc. has indicated that

it wants to be a segment consolidator. Each company is committed to attract as many vis-

itors (as Exhibit 8 demonstrates) as possible. The industry, due to its low barrier entry—

technical and regulatory—makes the projection of its business viability for existing

companies difficult. Due to changes in legislative requirements concerning technology

sharing, patent rights, and information security, future expenses and profitability of the

companies operating within this industry are harder to predict. Future innovations and

shifts in technology also make long-term strategies regarding the Internet and software

services industry difficult.

EXHIBIT 8 Top 25 Internet Properties

Top 25 Internet Properties † Unique Visitors (000) % Reach *

1. Google sites 140,163 73.8

2. Yahoo! sites 140,080 73.8

3. Microsoft sites 119,677 63.0

4. AOL 110,841 58.4

5. Fox Interactive Media 85,998 45.3

6. eBay 72,972 38.4

7. Amazon sites 57,002 30.0

8. Wikipedia sites 53,337 28.1

9. Ask.com network 51,646 27.2

10. Apple Inc. 45,396 23.9

11. Viacom Digital 45,053 23.7

12. Turner Network 43,515 22.9

13. New York Times Digital 42,373 22.3

14. Glam Media 40,775 N/A

15. Facebook.com 37,375 19.7

16. The Weather Channel 34,963 18.4

17. CNET Networks 32,822 17.3

continued