Page 502 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 502

488 The Complete Guide to Executive Compensation

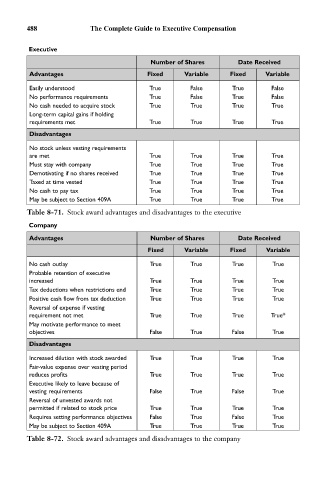

Executive

Number of Shares Date Received

Advantages Fixed Variable Fixed Variable

Easily understood True False True False

No performance requirements True False True False

No cash needed to acquire stock True True True True

Long-term capital gains if holding

requirements met True True True True

Disadvantages

No stock unless vesting requirements

are met True True True True

Must stay with company True True True True

Demotivating if no shares received True True True True

Taxed at time vested True True True True

No cash to pay tax True True True True

May be subject to Section 409A True True True True

Table 8-71. Stock award advantages and disadvantages to the executive

Company

Advantages Number of Shares Date Received

Fixed Variable Fixed Variable

No cash outlay True True True True

Probable retention of executive

increased True True True True

Tax deductions when restrictions end True True True True

Positive cash flow from tax deduction True True True True

Reversal of expense if vesting

requirement not met True True True True*

May motivate performance to meet

objectives False True False True

Disadvantages

Increased dilution with stock awarded True True True True

Fair-value expense over vesting period

reduces profits True True True True

Executive likely to leave because of

vesting requirements False True False True

Reversal of unvested awards not

permitted if related to stock price True True True True

Requires setting performance objectives False True False True

May be subject to Section 409A True True True True

Table 8-72. Stock award advantages and disadvantages to the company