Page 500 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 500

486 The Complete Guide to Executive Compensation

Percentile EPS Shares of Company Stock

81–100 6,667 8,334 10,000 11,667 13,334

61–80 5,000 6,667 8,334 10,000 11,667

41–60 3,334 5,000 6,667 8,334 10,000

21–40 1,667 3,334 5,000 6,667 8,334

0–20 — 1,667 3,334 5,000 6,667

Total Shareholder Return Percentile

0–20 21–40 41–60 61–80 81–100

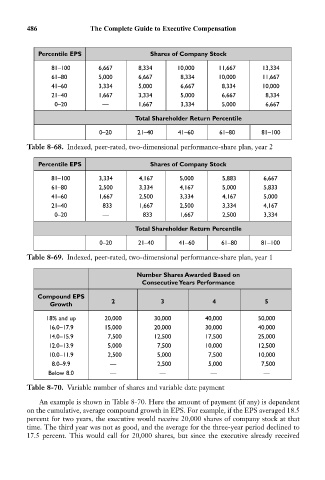

Table 8-68. Indexed, peer-rated, two-dimensional performance-share plan, year 2

Percentile EPS Shares of Company Stock

81–100 3,334 4,167 5,000 5,883 6,667

61–80 2,500 3,334 4,167 5,000 5,833

41–60 1,667 2,500 3,334 4,167 5,000

21–40 833 1,667 2,500 3,334 4,167

0–20 — 833 1,667 2,500 3,334

Total Shareholder Return Percentile

0–20 21–40 41–60 61–80 81–100

Table 8-69. Indexed, peer-rated, two-dimensional performance-share plan, year 1

Number Shares Awarded Based on

Consecutive Years Performance

Compound EPS

2 3 4 5

Growth

18% and up 20,000 30,000 40,000 50,000

16.0–17.9 15,000 20,000 30,000 40,000

14.0–15.9 7,500 12,500 17,500 25,000

12.0–13.9 5,000 7,500 10,000 12,500

10.0–11.9 2,500 5,000 7,500 10,000

8.0–9.9 — 2,500 5,000 7,500

Below 8.0 — — — —

Table 8-70. Variable number of shares and variable date payment

An example is shown in Table 8-70. Here the amount of payment (if any) is dependent

on the cumulative, average compound growth in EPS. For example, if the EPS averaged 18.5

percent for two years, the executive would receive 20,000 shares of company stock at that

time. The third year was not as good, and the average for the three-year period declined to

17.5 percent. This would call for 20,000 shares, but since the executive already received