Page 495 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 495

Chapter 8. Long-Term Incentives 481

Compound Growth in EPS Percent of FMV of

Over Period, Percent Stock Paid in Cash

Maximum 22 or higher 100%

19.0–21.9 87.5%

16.0–18.9 75%

13.0–15.9 62.5%

Target 10.0–12.9 50%

Threshold 7.0–9.9 25%

Below 7 0%

Table 8-62. Contingent cash bonus based on company performance

However, it illustrates several design variables, namely, smaller incremental steps above

50 percent and a zero award at a slightly higher EPS growth (i.e., 7 percent). Note also a

more aggressive high-end EPS requirement (i.e., 22 percent or higher) to receive the

maximum payout. This type of program would require determining how much one is willing

to pay in stock-plus-cash at target, threshold, and maximum. If for example, target were

set at 10 percent to 12.9 percent of compound growth in EPS, the stock portion would be

two-thirds of the total and cash one-third, since cash is 50 percent of stock value. This would

suggest a stock award of 10,000 shares rather than the 15,000 in the earlier example.

Another variation would be to use both Table 8-59 and Table 8-61, although it would be

logical that the EPS factors be the same for both the number of shares and the amount of the

cash award. This is illustrated in Table 8-63. Assume that it is a cliff-vested plan and that we

set the target at $1.5 million, half in stock (7,500 valued at $100 a share) and $750,000 in cash.

If after three years, the compound growth rate were 23 percent, the executive would receive

15,000 shares (7,500 200 percent) worth $1.95 million (because the FMV of the stock price

was at $130 a share) and a cash award of $1.95 million (i.e., 15,000 shares $130). Thus, the

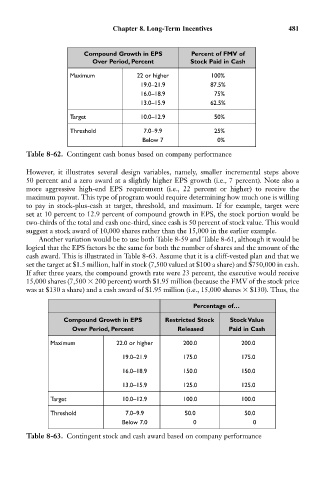

Percentage of…

Compound Growth in EPS Restricted Stock Stock Value

Over Period, Percent Released Paid in Cash

Maximum 22.0 or higher 200.0 200.0

19.0–21.9 175.0 175.0

16.0–18.9 150.0 150.0

13.0–15.9 125.0 125.0

Target 10.0–12.9 100.0 100.0

Threshold 7.0–9.9 50.0 50.0

Below 7.0 0 0

Table 8-63. Contingent stock and cash award based on company performance