Page 584 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 584

570 The Complete Guide to Executive Compensation

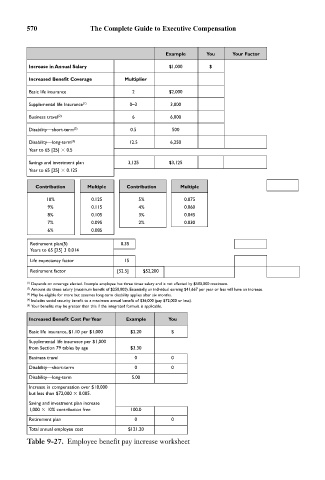

Example You Your Factor

Increase in Annual Salary $1,000 $

Increased Benefit Coverage Multiplier

Basic life insurance 2 $2,000

Supplemental life Insurance (1) 0–3 3,000

Business travel (2) 6 6,000

Disability—short-term (3) 0.5 500

Disability—long-term (4) 12.5 6,250

Year to 65 [25] 0.5

Savings and investment plan 3,125 $3,125

Year to 65 [25] 0.125

Contribution Multiple Contribution Multiple

10% 0.125 5% 0.075

9% 0.115 4% 0.060

8% 0.105 3% 0.045

7% 0.095 2% 0.030

6% 0.085

Retirement plan(5) 0.35

Years to 65 [25] 3 0.014

Life expectancy factor 15

Retirement factor [52.5] $52,200

(1) Depends on coverage elected. Example employee has three times salary and is not affected by $500,000 maximum.

(2) Amount six times salary (maximum benefit of $250,000). Essentially, an individual earning $41,667 per year or less will have an increase.

(3) May be eligible for more but assumes long-term disability applies after six months.

(4) Includes social security benefit to a maximum annual benefit of $36,000 (pay $72,000 or less).

(5) Your benefits may be greater than this if the integrated formula is applicable.

Increased Benefit Cost Per Year Example You

Basic life insurance, $1.10 per $1,000 $2.20 $

Supplemental life insurance per $1,000

from Section 79 tables by age $3.30

Business travel 0 0

Disability—short-term 0 0

Disability—long-term 5.00

Increase in compensation over $18,000

but less than $72,000 0.005.

Saving and investment plan increase

1,000 10% contribution free 100.0

Retirement plan 0 0

Total annual employee cost $121.20

Table 9-27. Employee benefit pay increase worksheet