Page 585 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 585

Chapter 9. Design and Communication Considerations 571

a plan to deliver when the executive performed well, but more likely it is simply a desire to

minimize efforts expended in nonproductive areas.

The board of directors (and its compensation committee) needs to know the objectives of

the plan, how it works, and the possible payouts before approving the plan. The same applies

to shareholders if they are asked to approve the plan. Legal bodies such as the SEC also have

a need to know, and they provide appropriate forms and guidance for such disclosure.

Who Is to Receive the Information?

Disclosure of the plan must be made to the SEC on Forms 8K and 10K. Forms 3, 4, and/or

5 need to be filed with the SEC for specific stock transactions. The shareholder proxy state-

ment must include requests for shareholder approval of certain plans, in addition to detailed

disclosure of pay received and deferred. See the “Company Disclosure” section of Chapter 4

(“The Stakeholders”) for more details on SEC reporting requirements, including the proxy

pay tables. The Department of Labor requires that employees receive information about

company pension and welfare plans. These and other legal requirements must be carefully

reviewed, especially since they change from time to time.

Having ensured that legal disclosure requirements are met, the company needs to

determine what additional information it will provide, when, to whom, and in what level of

detail. The basic reason for additional disclosure is to make certain the executive understands

the plan. This is especially important if the individual needs to make a decision at some point

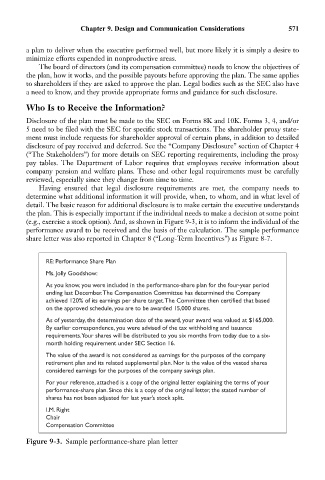

(e.g., exercise a stock option). And, as shown in Figure 9-3, it is to inform the individual of the

performance award to be received and the basis of the calculation. The sample performance

share letter was also reported in Chapter 8 (“Long-Term Incentives”) as Figure 8-7.

RE: Performance Share Plan

Ms. Jolly Goodshow:

As you know, you were included in the performance-share plan for the four-year period

ending last December. The Compensation Committee has determined the Company

achieved 120% of its earnings per share target. The Committee then certified that based

on the approved schedule, you are to be awarded 15,000 shares.

As of yesterday, the determination date of the award, your award was valued at $165,000.

By earlier correspondence, you were advised of the tax withholding and issuance

requirements. Your shares will be distributed to you six months from today due to a six-

month holding requirement under SEC Section 16.

The value of the award is not considered as earnings for the purposes of the company

retirement plan and its related supplemental plan. Nor is the value of the vested shares

considered earnings for the purposes of the company savings plan.

For your reference, attached is a copy of the original letter explaining the terms of your

performance-share plan. Since this is a copy of the original letter, the stated number of

shares has not been adjusted for last year’s stock split.

I.M. Right

Chair

Compensation Committee

Figure 9-3. Sample performance-share plan letter