Page 63 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 63

Chapter 2. Performance Measurements and Standards 49

shown in Table 2-6 are representative noncurrent (long-term) assets. They include long-term

investments ($28,347,700), long-term loans ($4,679,300), land ($47,065,400), buildings and

equipment (net of depreciation of $76,980,500), and goodwill (net of amortization of

$89,836,800), along with other longer-term, prepaid expenses and other assets ($4,786,700).

In the example, these total $251,696,400, resulting in a combined total of $330,997,900 for

current and noncurrent assets.

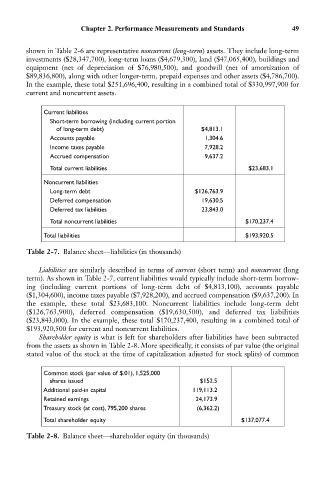

Current liabilities

Short-term borrowing (including current portion

of long-term debt) $4,813.1

Accounts payable 1,304.6

Income taxes payable 7,928.2

Accrued compensation 9,637.2

Total current liabilities $23,683.1

Noncurrent liabilities

Long-term debt $126,763.9

Deferred compensation 19,630.5

Deferred tax liabilities 23,843.0

Total noncurrent liabilities $170,237.4

Total liabilities $193,920.5

Table 2-7. Balance sheet—liabilities (in thousands)

Liabilities are similarly described in terms of current (short term) and noncurrent (long

term). As shown in Table 2-7, current liabilities would typically include short-term borrow-

ing (including current portions of long-term debt of $4,813,100), accounts payable

($1,304,600), income taxes payable ($7,928,200), and accrued compensation ($9,637,200). In

the example, these total $23,683,100. Noncurrent liabilities include long-term debt

($126,763,900), deferred compensation ($19,630,500), and deferred tax liabilities

($23,843,000). In the example, these total $170,237,400, resulting in a combined total of

$193,920,500 for current and noncurrent liabilities.

Shareholder equity is what is left for shareholders after liabilities have been subtracted

from the assets as shown in Table 2-8. More specifically, it consists of par value (the original

stated value of the stock at the time of capitalization adjusted for stock splits) of common

Common stock (par value of $.01), 1,525,000

shares issued $152.5

Additional paid-in capital 119,113.2

Retained earnings 24,173.9

Treasury stock (at cost), 795,200 shares (6,362.2)

Total shareholder equity $137,077.4

Table 2-8. Balance sheet—shareholder equity (in thousands)